Why are there so few Chinese cars in the United States?

Against the backdrop of globalization, automotive companies have been continuously seeking the best market layout strategies. However, in recent days, several Chinese car manufacturers are considering abandoning the US market and turning to embrace Latin America. Behind this shift lies the imposing tariff barrier of up to 27.5% and the increasingly challenging competitive landscape in the United States.

Faced with this situation, Chinese car companies are seeking new avenues. They have found that while the Latin American market may be relatively small in scale, it holds immense potential and is easier to enter. Therefore, these companies are establishing factories in places like Mexico and Brazil, shifting their focus to this new market full of opportunities.

How are Chinese car companies responding?

Taking BYD as an example, the company is actively preparing to establish a factory in Mexico. According to Zou Zhou, the head of BYD Mexico, overseas production is crucial, and Mexico, as an important market with tremendous potential, is an ideal choice for BYD’s international expansion. It is reported that BYD plans to select a site and begin construction of the factory by the end of the year, with a production capacity of up to 150,000 vehicles per year.

Meanwhile, BYD has also introduced several passenger cars and bus products into the Mexican market, gradually expanding its market share. These products are not only of high quality but also affordably priced, making them popular among local consumers.

In addition to BYD, other Chinese automakers are actively seeking opportunities in the Latin American market. They are establishing research and development centers and production bases in Mexico, Brazil, and other places, strengthening cooperation and communication with local companies to jointly promote the development of the automotive industry.

Have Chinese car companies given up on the U.S. market?

Of course, shifting towards the Latin American market does not mean that Chinese automakers are giving up on their pursuit of the US market. They continue to closely monitor the dynamics of the US market, seeking appropriate timing and methods to enter this market. However, under the current circumstances, the Latin American market undoubtedly represents a more practical and feasible choice.

Facing a 27.5% tariff barrier and intense competition in the US market, several Chinese automakers have chosen to abandon the US market and turn to Latin America. Although this shift may seem somewhat reluctant, it also reflects the flexibility and wisdom of Chinese automakers in responding to changes in the global trade environment.

Top 10 MPV Sales in China for March

With the rise in household demand, MPV models have garnered widespread attention from consumers. Many domestic brands have recognized the development opportunities in the MPV segment and actively introduced MPV models. For example, models such as the Denza D9, Xpeng X9, and GAC Trumpchi M8 have all achieved impressive sales performance in the market. Particularly noteworthy is the Denza D9, which surpassed the Buick GL8 in March sales, securing the top spot in the MPV segment. Now, let’s take a look back at the top ten MPV models in China for March.

NO.1 Denza D9

Sales volume: 10 thousand units

In February, Denza sold 4,016 units, but in March, sales surged to nearly 10,000 units, achieving a 140% sales growth. This significant increase propelled it up two spots in the rankings, surpassing the Buick GL8. The Denza D9 DM-i, as a mid-to-large-sized MPV, has dimensions of 5250mm*1960mm*1920mm and a wheelbase of 3110mm. The interior layout is designed for seven seats, while also offering a more luxurious four-seat version to meet the diverse needs of users.

NO.2 Buick GL8

Sales volume: 7.4 thousand units

The Buick GL8, as a joint venture MPV with a rich history, has maintained stable sales performance in the market. However, in recent years, with the rise of domestic independent brands and intensified market competition, the sales of Buick GL8 have shown some fluctuations. Especially in March, compared to other competing brands, its sales growth was not particularly significant. The dimensions of the Buick GL8 are 5219mm*1878mm*1805mm, with a wheelbase of 3088mm, offering both 6-seat and 7-seat seating layouts to meet the needs of different families and business purposes.

NO.3 Toyota Sienna

Sales volume: 6.7 thousand units

The GAC Toyota Sienna, as a long-standing and popular model among joint venture brands, primarily targets the family car market and continues to demonstrate stable sales performance. Despite not experiencing significant growth in sales in March, leading to a slight decline in its ranking, the Sienna still maintains a solid position in the top three. With dimensions of 5165mm*1995mm*1765mm and a wheelbase of 3060mm, this model falls into the category of mid-to-large-sized MPVs, featuring a 7-seat layout that fully caters to the needs of family travel.

NO.4 Trumpchi M8

Sales volume: 6 thousand units

In March, the sales performance of the GAC Trumpchi M8 showed a significant growth trend, jumping from 2070 units in February to 6031 units in March, achieving a remarkable 191% sales increase. Consequently, its ranking also rose by three places. The dimensions of this model are 5212mm*1893mm*1823mm, with a wheelbase of 3070mm, positioning it in the mid-to-large-sized MPV segment. The interior layout remains consistent with a 7-seat configuration.

NO.5 Trumpchi M6

Sales volume: 4.7 thousand units

Ranked fifth on the sales chart is the GAC Trumpchi M6, which sold 4684 units in March, showing an improvement compared to February’s sales. Although it slipped one spot in the rankings, the overall fluctuation was not significant. The dimensions of the GAC Trumpchi M6 are 4793mm*1837mm*1730mm, with a wheelbase of 2810mm, placing it in the compact MPV category. The vehicle maintains a 7-seat configuration, catering to everyday household needs.

NO.6 Xpeng X9

Sales volume: 3.9 thousand units

The Xpeng X9, as a recently launched model, has achieved commendable sales performance since its market introduction in January, with sales approaching 4000 units in March. This performance is noteworthy. Additionally, compared to February, the Xpeng X9 has climbed three spots in the rankings. The dimensions of this model are 5293mm*1988mm*1785mm, with a wheelbase of 3160mm.

NO.7 Toyota Granvia

Sales volume: 3.8 thousand units

The FAW Toyota‘s Granvia, a sister model to the Sienna, enjoys a good reputation in the market. Although sales increased slightly compared to February, there was a slight decline in rankings, falling back one spot. However, this fluctuation remains within the normal range of market dynamics. The dimensions of this model are 5175mm*1995mm*1785mm, with a wheelbase of 3060mm, and it features a 7-seater configuration.

NO.8 Li Auto MEGA

Sales volume: 3.2 thousand units

As a newly launched model in March, this car has successfully entered the top ten in terms of sales, achieving sales of over 3000 units, which is a commendable achievement. The dimensions of this model are 5350mm*1965mm*1850mm, with a wheelbase of 3300mm, and it features a 7-seater layout. In terms of exterior design, this car exhibits distinctive personalized features, with an overall style that is modern and futuristic, leaving a lasting impression on people.

NO.9 Dongfeng Forthing Lingzhi

Sales volume: 3.2 thousand units

As a mid-size MPV under Dongfeng Forthing, the Lingzhi sold 1497 units in February. In March, its sales saw a significant increase, reaching 3206 units, showing a clear growth trend. Despite the increase in sales, it slightly dropped in ranking, moving back one place. The dimensions of this model are 5135mm*1720mm*1970mm, with a wheelbase of 3000mm.

NO.10 Voyah Dreamer

Sales volume: 3.1 thousand units

In February, the sales of the Voyah Dreamer PHEV were 1166 units. By March, the sales increased to 2764 units. Compared to February, it climbed one place in ranking, successfully entering the top ten in sales. This model has dimensions of 5315mm*1985mm*1800mm, with a wheelbase of 3200mm, positioning it as a mid-to-large-sized MPV to meet diverse needs for family and business travel.

Summary:

Looking at the performance of this round of rankings, the market share of Chinese brands in the top ten sales of MPV models has gradually increased. Particularly noteworthy is that the monthly sales of the Denza D9 DM-i have surpassed those of the Buick GL8, demonstrating the increasing strength of Chinese car models. However, it’s worth noting that joint venture brands have initiated a new round of price reductions. As we enter April, competition among major models will intensify even further.

Is automotive-grade solid-state battery ready to be used soon?

Even novices understand that in the era of new energy vehicles, whoever can solve the three major challenges of battery charging, energy storage, and endurance will become the leader of this era.

Although these three major challenges do not yet have standard answers, the faster the charging, the higher the energy storage, and the more stable the endurance, the higher the competitiveness will be!

Currently, new energy vehicles on the market generally use semi-solid-state batteries, so everyone’s hope is placed on solid-state batteries. Many related enterprises and automakers are also investing in research and development in this area.

What is an all-solid-state battery?

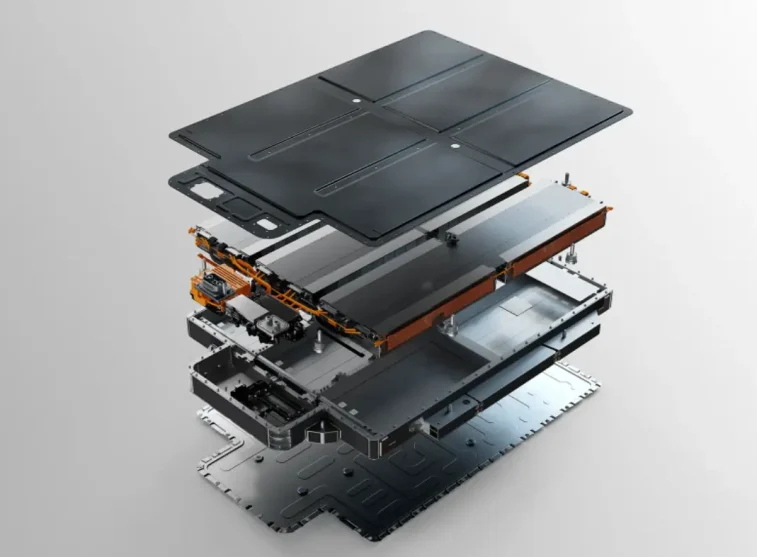

Simply put, all materials that make up the battery are solid-state. In contrast, the structure of current automotive-grade semi-solid-state batteries consists of one electrode side without liquid electrolyte, while the other electrode side contains liquid electrolyte.

In comparison, solid-state batteries offer advantages such as high energy density, strong cycling performance, high tolerance to extreme temperatures, no leakage, and improved safety. The current issues of “rapid degradation in high/low temperatures” and “overstated range” in new energy vehicles stem from the fact that they do not possess the characteristics of solid-state batteries.

Are all-solid-state batteries in mass production?

In fact, solid-state batteries have been applied in multiple fields, but there is currently no mass-produced commercial-grade solid-state battery available.

Although in January this year, ProLogium Technology (China Taiwan) announced the production of the world’s first automotive-grade solid-state battery production line (in Taoyuan, Taiwan), claiming that the new large lithium ceramic battery can be charged to 80% in just 12 minutes, achieving a range of 1000 kilometers and a cycle life of over 1000 times.

However, ProLogium Technology also provided data indicating an annual production capacity of 26,000 units. Currently, this capacity falls far short of meeting the production and sales pace of new energy vehicles.

However, the recently unveiled IM Motors L6 claims to use solid-state batteries, boasting a nearly 900V high-voltage fast charging capability and a range of over 1000 kilometers!

According to the data released by IM Motors L6, the MAX standard version uses lithium iron phosphate batteries (from Contemporary Amperex Technology) and ternary lithium batteries (from CATL), with ranges of 650 kilometers and 780 kilometers, respectively. However, no information regarding solid-state batteries has been provided.

CATL

However, during the performance interpretation meeting of CATL in March this year, Zeng Yuqun stated that, technically, solid-state batteries still face many fundamental scientific issues such as solid-state ion diffusion, and they are far from being commercialized.

We also need to understand that there is an “impossible triangle” in the field of power batteries, which means combining “higher energy density, higher safety, and lower cost” into one battery.

This implies that with the current battery technology, even if mass-produced, high-energy-density, high-safety vehicle-grade solid-state batteries, consumers with ordinary income may not be able to afford them!

This involves research and development investment, material costs, manufacturing costs, and so on. In fact, in the eyes of some industry insiders, rather than focusing on developing vehicle-grade solid-state batteries, it might be more worthwhile to directly leapfrog to hydrogen fuel cells.

According to information released by Sinopec, the company has already reduced the production cost of hydrogen to 1.3 yuan per cubic meter. If they can solve the technical challenges related to transportation, storage, application, and safety on this basis, I believe it would be more worthwhile to vigorously develop hydrogen fuel cells than solid-state batteries. What do you think?

Top 10 China’s March high-end SUV sales rankings

The improvement in China’s consumer purchasing power has led more and more consumers to pay attention to the high-end SUV market. Recently, the sales ranking for March in China has been officially released. From the list, it can be seen that the three major German giants still occupy the top positions. Meanwhile, as a representative of domestic production, Li Auto has three SUV models on the list. Let’s take a look at the performance of each model.

NO.1 Mercedes-Benz GLC

Sales: 19,000 units

In March, Mercedes-Benz GLC sold 19,000 new cars. Looking back at the sales situation over the past six months, Mercedes-Benz GLC has shown a significant growth trend in sales. Initially, monthly sales dropped from 12,000 units to a low point of about 5,000 units. However, it then rebounded, with sales steadily increasing. By March, monthly sales had reached nearly 20,000 units. The growth in sales is closely related to pricing adjustment strategies. The introduction of new models still maintains the same level of discounts as the old models, significantly enhancing the cost-effectiveness.

NO.2 Audi Q5L

Sales: 11,598 units

In March, Audi Q5L sold 11,598 new cars. After reaching its peak in December last year, Audi Q5L experienced a significant decline in sales in January and February, with February sales dropping to as low as 7,676 units. Although there was some recovery in March, it still lags far behind its peak. Currently, Audi Q5L still offers good discounts, but due to strong competition in the same segment, it has brought considerable pressure to Audi Q5L.

NO.3 Li Auto L7

Sales: 10,768 units

As the entry-level model of the Li Auto L series, the Li Auto L7 maintains excellent performance in terms of configuration and space. In March, the Li Auto L7 achieved sales of 10,768 new cars in the domestic market. Looking at the sales performance over the past few months, the Li Auto L7 has experienced a significant decline, mainly due to the launch of the AITO M7. After reaching new highs month by month last year and achieving a record of 20,428 units, sales have declined month by month this year. Although there was some recovery in March, it still remains close to halving compared to December last year.

NO.4 BMW X3

Sales: 10,119 units

The BMW X3 ranked fourth on the list with sales of 10,119 units. However, looking at the sales performance over the past few months, the BMW X3 has shown relatively stable sales. Although there was a slight decline in February, it reached a new high of 12,987 units in January. The average sales level in recent months has also been around 10,000 units. However, for BMW, this sales performance is evidently not satisfactory.

NO.5 Li Auto L9

Sales: 8,595 units

As the flagship SUV of the Li Auto family, the Li Auto L9 sets high standards in terms of configuration and size. However, looking at the sales performance over the past few months, the Li Auto L9 has encountered a similar issue as the Li Auto L7. After entering 2024, its sales have experienced a significant decline, with sales in March reaching only 8,595 units, lower than the average level of around 12,000 units last year.

NO.6 BMW X5

Sales: 7,448 units

Although the BMW X5 is a luxury midsize SUV, its sales performance remains strong. With 7,448 units sold in March, it topped the luxury midsize SUV sales chart. Its monthly performance is also similar to that of the BMW X3. While most models experienced a decline in sales, the monthly average sales of the BMW X5 remained robust. This demonstrates the strong brand appeal of the BMW X5.

NO.7 Li Auto L8

Sales: 6,392 units

The Li Auto L8 ranks 7th on the chart with sales of 6,392 new cars. However, its sales performance is the weakest among the Li Auto L series. It is noteworthy that its current sales level is also half of last year’s. While the Li Auto L7 and Li Auto L9 have shown relatively clear rebound growth compared to February, the Li Auto L8’s month-on-month growth is not significant. Ideal may need to adopt more strategies to ensure sales.

NO.8 Volvo XC60

Sales: 6,079 units

Despite not achieving high absolute sales numbers, the Volvo XC60 still demonstrates sufficient resilience in maintaining sales compared to last year. Although there was a significant decline in February, with sales dropping to only 3,441 units, the figures rebounded to 6,079 units in March. Currently, new cars are being offered with significant discounts, and it is anticipated that the sales performance will remain balanced in the future.

NO.9 AITO M9

Sales: 5,446 units

As the flagship SUV of SERES AITO, the AITO M9 achieved sales of 5,446 units in March. Compared to its competitors, the AITO M9 targets Li Auto L9. Although there is currently a gap in sales between the two, the AITO M9’s advantage lies in its intelligence. With advancements in the field of intelligent driving in the future, the AITO M9 is highly likely to achieve further sales growth.

NO.10 NIO ES6

Sales: 3,729 units

Just squeezing into the tenth spot on the sales chart is the NIO ES6. As the former leader of the “Big Three” Chinese electric vehicle new brands, NIO‘s current development is clearly lagging behind Li Auto, and it also subtly hints at some development crises. In March sales, the NIO ES6 sold only 3,729 units, and looking at the sales trend over the past seven months, it also shows a monthly decline.

Summary

From the performance of the models on the sales chart above, it can be seen that Chinese new energy brands have experienced more or less of a downward trend in sales performance. This may be largely related to the deteriorating competitive environment and price wars. In contrast, traditional luxury brands have mainly shown stability compared to last year. Which camp’s performance do you think has a better outlook?

China’s automobile sales in the first quarter of 2024

In the first quarter of 2024, the Chinese automotive industry started steadily, laying a solid foundation for the whole year.

Robust Growth Trend

Specifically, both passenger and commercial vehicle production and sales are showing a robust growth trend. The rapid development trend of electric cars continues, with a stable market share of 30% in China. The country’s overall vehicle exports remain at a high level, continuing to play an active role in driving industry growth. Meanwhile, domestic Chinese brands maintain their growth momentum and retain a higher market share.

Production and Sales Data Overview

According to data from the China Association of Automobile Manufacturers (CAAM), in March alone, China produced a total of 2.687 million vehicles, an increase of 78.4% compared to the previous month and a 4% increase from the same period last year. In the same month, Chinese automakers sold approximately 2.694 million vehicles, marking a staggering 70.2% year-on-year increase and a 9.9% month-on-month growth. For the first quarter of this year, China’s cumulative vehicle production and sales reached 6.606 million and 6.72 million units, respectively, representing year-on-year growth rates of 6.4% and 10.6%.

Performance of the Electric Vehicle Market

In the past month, Chinese automakers produced and sold 863,000 and 477,000 electric vehicles, respectively, marking year-on-year increases of 28.1% and 35.3%. March saw electric vehicle sales reach 758,000 units, representing a 92.1% month-on-month growth and a 32% year-on-year increase. Concurrently, China exported 124,000 electric vehicles to overseas markets last month, marking year-on-year growth rates of 52% and 59.4%, respectively. For the first three months of 2024, China’s electric vehicle production and sales reached approximately 2.115 million and 2.09 million units, with year-on-year growth rates of 28.2% and 31.8%, respectively. During this period, electric vehicles accounted for 31.1% of the total national automobile sales. In the first quarter of 2024, domestic electric vehicle sales reached 1.783 million units, showing a 33.3% year-on-year increase. Additionally, electric vehicle exports in the first quarter reached 307,000 units, marking a 23.8% year-on-year growth.

China Automobile Export Data

In March 2024, China exported 502,000 vehicles to overseas markets, marking a 33% month-on-month increase and a 37.9% year-on-year increase. Of the vehicles exported last month, approximately 424,000 were passenger cars, showing month-on-month and year-on-year growth rates of 34.6% and 39.3%, respectively. Meanwhile, the export volume of commercial vehicles amounted to 78,000 units, achieving month-on-month and year-on-year growth rates of 24.9% and 31%, respectively. For the first quarter of 2024, China’s cumulative automobile export volume reached 1.324 million units, reflecting a 33.2% year-on-year increase. From the beginning of the year to date, passenger car exports totaled approximately 1.11 million units (up by 34.3% year-on-year), while commercial vehicle exports amounted to approximately 214,000 units (up by 27.5% year-on-year).

Brand Performance

In terms of individual automobile brands, in March 2024, SAIC Group surpassed Chery to claim the title of monthly export champion, with overseas sales reaching 96,000 units, marking a 10.6% year-on-year increase. It is worth noting that SAIC Group’s export volume over the past month accounted for 19.1% of China’s total automobile exports. Additionally, Chinese electric vehicle giant BYD achieved outstanding growth in automobile exports. In March, BYD shipped 39,000 units to foreign markets, representing a remarkable 1.7-fold year-on-year increase.

Li Auto L6 is coming soon

Recently, we obtained news from the official source of the domestic Li Auto that its mid-to-large-sized SUV model, the Li Auto L6, has announced its official launch date. The new vehicle is set to be released on April 18th, with an estimated price range between 250,000 to 300,000 CNY. Positioned and sized smaller than the Li Auto L7, how will the new car perform? According to the information we have obtained, let’s find out more together.

Appearance

As a new model built on Li Auto’s second-generation extended-range platform, the design layout of the new car shares many similarities with the Li Auto L7. Based on the leaked real-life images, the overall exterior of the new car adopts classic trendy design elements of contemporary new energy vehicles, showcasing a fashionable and avant-garde appearance. In terms of the front face, the design achieves a balance between roundedness and sharpness. The sharpness is evident in the closed front face composed of sharp lines in the middle, along with the integrated smoked front headlights, while the roundedness can be seen in the front bumper, giving it a handsome look.

Space

The dimensions of the Li Auto L6 are 492519601735 millimeters, with a wheelbase of 2920 millimeters, making it smaller in size compared to the Li Auto L7 (505019951750 millimeters). The design of the vehicle’s side profile and rear continues the styling of the Li Auto L-series family, featuring smooth and dynamic lines, although the rear door windows are shorter. The license plate holder at the rear is positioned in the middle of the rear bumper, and the reflector strips on both sides of the rear bumper have been removed, creating a cohesive look with the front headlights and tail lights.

Interior

Upon entering the cabin, the interior of the Li Auto L6 remains highly consistent with that of the Li Auto L7. The most striking and prominent feature inside the car is the dual 15.3-inch center console screen + passenger screen, forming a suspended dual-screen setup. Beneath the air vents are dual wireless charging pads for smartphones, with a practical addition of cup holders at the rear. In just 9 days, the Li Auto L6 will be launched, equipped with a 1.5T range extender and a pure electric range of 172 kilometers.

Power

Based on the previously reported information, the Li Auto L6 is equipped with a 1.5T range extender produced by Sichuan Ideal New Morning Technology Co., Ltd., with a maximum output power of 113 kilowatts. It is also equipped with a 35.8 kWh lithium iron phosphate battery produced by companies like CATL. The comprehensive electric range under normal operating conditions is 172 kilometers, making it more cost-effective compared to the Li Auto L7.

The Li Auto L6 launch date is set for April 18th, Beijing time. Let’s see what surprises await us then.

Spy photos of BYD’s first electric pickup truck exposed

Recently, the official spy photos of BYD‘s first electric pickup truck have been exposed. The vehicle is developed for the global market and is expected to be unveiled and launched overseas later this year.

BYD’s first electric pickup truck

In terms of appearance, the new car adopts an 8-shaped design for the front headlights, with two lens modules inside. The grille area is relatively large, representing a typical rugged pickup truck style, and the lower part of the front bumper is also equipped with metal skid plate decoration.

On the side of the vehicle, it adopts the mainstream dual-row seating layout and is equipped with side steps. Roof racks and roll bars are provided at positions such as the roof and the rear of the vehicle.

At the rear, the vertically positioned taillights echo the design of the front headlights, with the taillight contours adopting a three-dimensional angular shape.

About its power

In terms of powertrain, the BYD new energy pickup truck may offer both plug-in hybrid and pure electric versions, with the hybrid version expected to provide a comprehensive range of 800-1200km, and the pure electric range around 100km. According to earlier reports, this pickup truck is expected to be equipped with features such as hydraulic active suspension system, streaming rearview mirrors, and Huawei AR-HUD.

BYD’s entry into the pickup truck market, if priced affordably, could pose a significant challenge to Great Wall Motors’ market share in China, as demonstrated by the previous Fangchengbao Bao 5. So, the question arises: how will Great Wall Motors respond to BYD’s relentless competition? Perhaps only time will tell.

Chery iCAR brand new car V23 debuts

Recently, the iCAR V23 made its official debut, marking the first model jointly developed by Chery and Zhimi Technology. Positioned as a pure electric compact SUV, the vehicle boasts an official range of up to 500 kilometers. Additionally, the iCAR V23 serves as the inaugural model of the iCAR brand’s new V series, focusing primarily on off-road styled vehicles (while the 0 series, represented by the iCAR 03 (Jaecoo 6), will emphasize a refined and technological aesthetic). The car is expected to debut at the Beijing Auto Show and is planned to commence pre-sales, market launch, and deliveries in the latter half of the year.

New car features

Based on real-life images, the exterior design of the iCAR V23 maintains the rugged SUV style commonly seen in “boxy” designs. However, modern touches are applied to details, including robust bumpers, round light designs, raised hood, and widened wheel arches. Additionally, the vehicle will feature a new brand emblem and be equipped with millimeter-wave radar technology.

Side

From the side profile, the iCAR V23 adopts a four-wheel-four-corner design layout, featuring roof rails, concealed door handles, and side steps. In terms of dimensions, the iCAR V23 measures 4220/1915/1845 millimeters in length, width, and height respectively, with a wheelbase of 2730 millimeters. The overall dimensions are similar to those of the iCAR 03 (4406/1910/1715 millimeters, with a wheelbase of 2715 millimeters), and larger than the Baojun Yueye Plus (3996/1760/1726 millimeters, with a wheelbase of 2560 millimeters), which is positioned similarly.

Furthermore, the iCAR V23 offers an approach angle of 42/43 degrees and a departure angle of 40/41 degrees, with a minimum ground clearance of 206/212 millimeters (for the front-wheel-drive and all-wheel-drive versions respectively). Additionally, it comes with options for either 19-inch or 21-inch wheels.

Rear

The styling of the rear end of the iCAR V23 complements its front face. The tailgate will feature a side-opening mechanism, with an externally-mounted storage compartment that is internally accessible, serving as additional storage space. However, it is worth noting that this compartment cannot be opened from the outside. Additionally, the vehicle is equipped with a total of four millimeter-wave radars, enabling L2+ intelligent driving assistance functions.

Interior

Currently, the interior of the iCAR V23 has not been revealed, but it is expected to continue the interior style used in the iCAR 03, which includes a large central touchscreen and physical buttons on the center console. However, it is regrettable that the vehicle’s infotainment system does not feature the popular 8295 chip, but rather utilizes the more common 8155 chip.

iCAR brand:

As a new venture by Chery in the field of new energy vehicles, the iCAR brand adopts a completely different design approach from its previous brand models. This endeavor also involves the participation of Xiaomi’s ecological chain enterprise, Zhimi Technology. Taking the iCAR V23 as an example, Zhimi Technology’s team is responsible for product definition, styling design, engineering research and innovation marketing. On the other hand, Chery’s iCAR is responsible for development, production, channel construction, sales, delivery, and service. Moving forward, both parties will continue to follow this model to develop more products. According to the plan, iCAR aims to launch 6-8 models within the next three years.

Prospect analysis:

Returning to the product itself, the positioning of the iCAR V23 is very close to the already launched iCAR 03, which may lead to a situation of “fighting within the same family.” However, benefiting from the advantage of being a latecomer and with the support of Zhimi Technology, the iCAR V23 is expected to focus on human-machine interaction, similar to Xiaomi’s approach in the automotive sector. Additionally, with its rugged styling, the electric compact SUV segment is becoming a focus for some automakers. In the future, the iCAR V23 may face direct competition from models like the Baojun Yueye Plus.

What is the sub-brand of Xpeng?

Among the recognized three major players in the Chinese electric vehicle new brand arena, besides Li Auto, which currently maintains strong profitability, good financial condition, and outstanding market performance, both NIO and Xpeng are facing similar challenges. That is, their market performance has yet to break through, and they have been unable to rapidly increase sales, resulting in long-term substantial losses.

And they have all coincidentally turned to the strategy of “downsizing attacks,” by launching sub-brands to boost sales.

The sub-brand

Among them, NIO’s sub-brand is “ONVO,” positioned in the 200,000 to 300,000 RMB range. Xpeng, on the other hand, is more aggressive, promoting its new sub-brand that will enter the 100,000 to 150,000 RMB level of the automotive market by integrating Didi Global Inc.’s car-making technology. Given the collaboration with Didi and this price range, one can’t help but wonder, what is Xpeng up to? Are they preparing to compete in the ride-hailing market against GAC AION, BAIC, and BYD? Today, let’s discuss Xpeng’s strategy and its intended goals, and what effects it may have.

MONA

Let’s first take a look at the basic information of Xpeng’s new sub-brand. Xpeng’s sub-brand, currently codenamed “MONA,” is positioned in the price range of 100,000 to 150,000 RMB, aiming to create AI-driven cars targeted at young people. The first model is expected to be launched in the third quarter of this year. Leveraging Didi’s car-making technology base and Xpeng’s self-developed assisted driving and intelligent cockpit technology, the vehicles will be manufactured in Xpeng’s factory. MONA will also adopt an independent brand identity and establish new sales channels.

The first model of MONA

Currently, spy photos of the first model of MONA have been exposed. The new car is positioned as a compact pure electric sedan, adopting the popular minimalist design language. The most prominent feature of the front end is the T-shaped LED headlights, exuding a strong sense of technology. The overall design features a three-box body shape with a floating roof and hidden door handles. According to official teaser images, the C-pillar adopts a segmented visual design. As for the taillights, they seem to echo the styling of the headlights.

In addition, it can be observed that there is no provision for millimeter-wave radar in the front end, and the camera window at the top of the windshield is relatively wide. From this, it can be roughly inferred that MONA will focus on using vision-based L2-level driver assistance systems to reduce hardware costs.

In terms of interior design, MONA showcases its unique charm as an intelligent mobility product. The cabin adopts the mainstream T-shaped design, paired with a three-spoke multifunction steering wheel and a large central control screen. Currently, information regarding the powertrain remains undisclosed. In terms of the chassis, it will utilize a front MacPherson and rear torsion beam structure. It is reported that the expected price of this new car will be around 150,000 RMB.

Why did Xpeng create an independent low-end sub-brand?

Price

From the currently available public information, MONA’s positioning actually overlaps with the entry-level price range of Xpeng’s current models, the P5 and G3. If MONA enters the market at this price point, it will create internal competition. Therefore, there is some reason to believe that in the future, the P5 and G3 models may face discontinuation, allowing the Xpeng brand to focus on the mid-to-high-end market above 200,000 RMB, making way for the sub-brand MONA. So, why does Xpeng want to create an independent sub-brand?

Firstly, Xpeng currently has a very urgent need to boost sales. According to data, Xpeng sold 141,601 vehicles in 2023, falling short not only of the targeted 376,000 units but also behind NIO’s 160,000 units and Leapmotor’s 144,000 units. Therefore, rapidly increasing sales to reduce manufacturing costs is currently Xpeng’s most important challenge.

More importantly, Xpeng is a brand focused on intelligence, and the continuous improvement of AI-supported smart driving and intelligent cockpit features relies on a significant amount of vehicle data feedback for iteration. This helps spread out research and development costs, improve feature experiences, and enhance software monetization capabilities. Therefore, ramping up production volume is crucial for Xpeng in multiple ways.

Currently, Xpeng’s product lineup has been largely established in the 200,000 to 300,000 RMB price range, with models like the P7i sedan and the G6/G9 SUV serving as sales leaders. In such a scenario, reducing prices or introducing cheaper models would indeed be the best choice. However, directly lowering prices might potentially damage Xpeng’s existing brand image. Therefore, introducing an independent sub-brand to differentiate it from the parent brand is a good choice to maintain Xpeng’s consumer-oriented DNA.

Appearance

Additionally, according to some internal sources, the MONA project actually originated from a previously abandoned car-making project at Didi. The complete vehicle technology from this project has been sold to Xpeng, which originally came from Didi’s team. This budget-friendly model might not align with Xpeng’s existing design style, hence establishing it as an independent sub-brand ensures both consistency in the family’s characteristics and reduces the cost of modification and adaptation.

Is Xpeng suitable to create an independent sub-brand?

However, in our view, turning MONA into a sub-brand directly may not necessarily be a good approach.

Firstly, Xpeng’s label of intelligence alone cannot fully support the premium brand image it desires. The current market performance of all Xpeng models is a good illustration of this. The early emphasis on advanced intelligent driving with the P5 model did not manage to elevate its brand image or achieve a breakthrough in sales.

On the contrary, with the continuous iteration of intelligent technology, costs will inevitably decrease. From this perspective, the parent brand of Xpeng may even evolve towards affordability. Introducing a sub-brand could result in self-cannibalization between the two brands in the price range below 200,000 RMB. Moreover, establishing a new independent brand will incur significant channel construction costs and additional investments in the initial stage.

More importantly, in the price range of 100,000 to 200,000 RMB, traditional domestic automakers like BYD and Geely already have a significant lead in product lines and market share. Without a competitive advantage beyond intelligent driving, MONA may struggle to survive amidst fierce competition.

In summary, Xpeng’s introduction of MONA has its rationale, but it also carries certain risks.

What car brand is ONVO? What is its relationship with NIO?

On March 13th, the authentic spy photos of the first model of NIO’s sub-brand were exposed online. At the same time, the official name of NIO’s sub-brand has been confirmed as “LeDao Automotive,” with the first model named LeDao L60. The English name for LeDao Automotive is ONVO, with the letter “N” forming the brand logo.

ONVO is a sub-brand of NIO.

NIO Chairman William Li(Li Bin) explained the Chinese meaning of the brand name “LeDao” to users: “LeDao” signifies family happiness, adept household management, and engaging in enjoyable conversations.

Public records show that NIO has previously registered multiple new trademarks, including “LeDao,” “Dongliang,” “Xiangxiang,” and others. Among them, the application date for “LeDao” is July 13, 2022, with NIO Technology (Anhui) Co., Ltd. listed as the applicant.

NIO’s plans for the new brand(ONVO)

As the time approaches, more details about the new brand(ONVO) are gradually emerging.

During a recent earnings call, Li Bin stated that NIO’s new brand aimed at the mass consumer market will be unveiled in the second quarter of this year, with the first model set for release in the third quarter and mass deliveries expected to commence in the fourth quarter.

Li Bin also revealed that the second model under the new brand, an SUV tailored for large families, has entered the mold-making stage and is scheduled for market release in 2025. Additionally, the third model is currently under development.

Based on existing models, the price range for vehicles under NIO’s second brand is expected to be between 200,000 and 300,000 RMB.

Li Bin indicated that this new model will directly compete with the Tesla Model Y and will cost about 10% less to produce. Considering the current price range of the Tesla Model Y at 258,900 to 363,900 RMB, a 10% reduction in cost suggests that the starting price of the new model could be around 230,000 RMB. Given that the lowest-priced NIO model, the ET5, starts at 298,000 RMB, it can be inferred that the high-end version of the new model should be priced below 300,000 RMB.

The difference between NIO and ONVO brands

In order to differentiate itself from NIO’s premium positioning, the new brand will establish an independent marketing channel. Li Bin stated that the new brand will utilize a separate sales network, but some of NIO’s existing after-sales systems will be used for post-sales service. “The company’s goal for 2024 is to establish no fewer than 200 offline networks for the new brand.”

Regarding battery swapping, the models of the new brand will also support battery swap technology, which has been one of NIO’s core competitive advantages. NIO announced that it will have two sets of battery swap networks: NIO’s dedicated network and a shared battery swap network. The models of the new brand will use the shared battery swap network.

The ONVO is crucial to NIO

Current status of NIO

In the industry’s view, the pricing of the new brand, which is more affordable, will be crucial for NIO to turn the tide this year.

On March 5th, NIO released its full-year financial report for 2023, showing year-on-year growth in revenue and sales, but a further widening of losses.

According to the financial report, NIO achieved total revenue of 55.62 billion RMB in 2023, a year-on-year increase of 12.9%; the full-year net loss further expanded by 43.5% to 20.72 billion RMB.

Currently, in terms of cash reserves, benefiting from two rounds of strategic investments totaling $3.3 billion from foreign investment institutions in the second half of last year, NIO’s cash reserves rose to 57.3 billion RMB by the end of 2023. Based on the current losses, NIO still has a safety period of three years.

“On the capital market front, NIO is favored by internationally renowned capital, which has significantly increased its cash reserves, providing sufficient funds to meet the ‘finals’ in 2025,” said NIO.

R&D investment is the main contributor to NIO’s losses, and it has been increasing year by year. In 2020 and 2021, NIO’s R&D investment was 2.5 billion RMB and 4.6 billion RMB, respectively. However, the growth rate subsequently increased rapidly, with R&D investment reaching 10.8 billion RMB in 2022, a year-on-year increase of over 134%. R&D investment in 2023 increased by 23.9% to 13.43 billion RMB.

However, in order to enhance competitiveness, NIO will not reduce its investment. Li Bin stated, “In the future, the company will continue to maintain R&D investment of around 3 billion RMB per quarter.”

Problems with NIO

For new energy vehicle companies, high R&D investment is not necessarily a bad thing, but NIO’s low return on investment is the key reason for industry skepticism.

Data shows that NIO delivered 160,000 vehicles throughout 2023, a 30.7% increase from 2022. In January of this year, NIO delivered 10,100 vehicles, and 8,132 vehicles in February. Sales volume remains a bottleneck for NIO. Despite adopting various promotional methods last year to temporarily boost delivery volume, NIO still failed to meet its annual sales target.

By contrast, in 2023, Li Auto‘s R&D investment was 1.059 billion RMB, with a net profit of 11.8 billion RMB, and annual sales of 376,000 vehicles.

However, during the conference call, Li Bin expressed optimism about NIO’s sales this year, confident in returning to a monthly sales level of 20,000 vehicles.

To return to the level of 20,000 vehicles per month, the second brand ONVO is crucial.

NIO’s future plans

Li Bin stated that the NIO brand will continue to focus more on gross profit margin, aiming for profitability rather than resorting to price wars to increase sales volume. On the other hand, the second brand will prioritize sales volume over gross profit margin, especially in the initial stages. He believes that this combination is a better strategy for the company’s long-term operations.

Additionally, Li Bin revealed that NIO will launch a new brand with a price tag of only tens of thousands of RMB next year, expanding the market coverage of NIO products.

In 2024, with another wave of price cuts looming, the competition in the automotive market is becoming increasingly fierce. It is expected within the industry that the automotive market will undergo a major reshuffle in the next two years. New players in the industry such as NIO and Xpeng, who have not yet turned a profit, need to make no mistakes if they want to break free from their predicament. From the perspective of cash reserves and brand planning, NIO has already made sufficient preparations and is ready for battle.