How to Choose the Best MPV for Your Family Travel

Multipurpose Vehicles (MPVs): A Modern Solution for Family Travel

MPVs, also known as minivans, have revolutionized family travel since their introduction in the 1980s. Designed to replace the traditional wagons used by American and British families, MPVs offer the perfect blend of passenger comfort and utility.

Unlike full-sized vans, MPVs are built on passenger car platforms, making them more focused on accommodating families and ensuring a smooth travel experience.

If you have a big family and are planning your next adventure, choosing the right MPV is crucial. This guide will help you navigate the essential factors to consider when selecting the best multipurpose vehicle for your family.

1. Power and Engine Performance

Why Engine Performance Matters

The engine is the heart of any vehicle, and this holds especially true for MPVs. Built to carry 8 to 9 passengers, MPVs often traverse long routes and challenging terrains. It’s essential to select a vehicle with adequate power to ensure safe and hassle-free journeys.

Mileage Considerations

Fuel efficiency is another critical factor. Given that MPVs are designed for family travel, they must offer decent mileage to cover long distances without frequent refueling stops. For instance, the Denza D9 DM-i, a hybrid MPV, provides an impressive range of 1050 km on a full charge, combining cost savings on fuel with top-tier efficiency.

2. Safety and Accessibility

Prioritizing Safety

Safety is paramount when traveling with family. MPVs should be equipped with comprehensive safety features to protect all passengers. Look for vehicles with multiple airbags, including side, front, and curtain airbags, to provide maximum protection in the event of a crash.

ZEEKR 009 is an MPV that has passed safety inspection. In a previous official test, after ZEEKR 009 was hit by an overturned mixer truck, all indicators were still relatively normal, the vehicle was able to drive normally, and the three-electric safety was all normal.

Ensuring Accessibility

Accessibility is also a key consideration. Families with young children or elderly members need vehicles with features like child locks and easy-to-access seating arrangements. Captain seats, which offer a center aisle for easy access to the rear rows, are particularly useful.

Additionally, rearview cameras are indispensable for parking and navigating tight spots, giving drivers a clear view of what’s behind the vehicle.

3. Comfort and Features

Creating a Comfortable Environment

For long family trips, comfort is crucial. MPVs are known for their spacious interiors, but additional features can enhance the travel experience. Climate control systems and reclining seats provide a relaxing environment.

Essential Modern Conveniences

Charging ports are vital for keeping devices powered during long journeys. Sunroofs offer an enjoyable overhead view and can provide relief from the sun’s heat. Advanced infotainment systems with GPS and multimedia support can entertain passengers and assist with navigation in remote areas.

The GAC Trumpchi M8 is an excellent example of an MPV packed with comfort features, boasting a 12.3-inch instrument panel for essential car information and a 14.6-inch screen for multimedia control.

4. Car Dimensions and Storage

Balancing Size and Storage Needs

Choosing an MPV involves balancing the vehicle’s size with your storage requirements. Larger models, like the Xpeng X9, offer ample space and storage for family trips but may be less maneuverable. Smaller MPVs, such as the GAC GM8, provide better handling and driving experience but might have limited storage capacity. Assess your needs and select an MPV that offers the right combination of space and maneuverability for your family’s adventures.

Conclusion

Selecting the perfect MPV for your family involves considering several factors, from engine performance and safety features to comfort, accessibility, and storage. By carefully evaluating these aspects, you can find an MPV that ensures a safe, comfortable, and enjoyable journey for your entire family.

What You Need to Know Before Choosing a Used Car From China

Are you planning to purchase a used car from China? China’s ever-growing used car market has become a goldmine for buyers. According to the China Automobile Dealers Association, more than 18.41 million used vehicles were purchased in 2023, with a total transaction value reaching $165.81 billion.

As the Chinese used car market expands, due diligence is paramount to ensure the purchase process is easy and you get a quality unit. In this guide, we’ll educate you on the key things to note before purchasing a used car from China. Read on!

Understand the Used Car Market

The Chinese used car market has been experiencing consistent growth since 2010. According to Statista, the market value 2010 was around 200 million Yuan, but by 2022, it had risen to around 1.1 billion yuan.

Usually, car owners sell their old cars during holidays after purchasing new ones for celebrations. Considering China’s automotive industry is growing with several automakers emerging from the country, the costs are reducing yearly. Reduced costs make it easier for owners to dispose of their old cars and acquire new ones.

China has numerous holidays all year, like the New Year, Qingming Festival, mid-autumn festival, and Golden Week, among others, making it easy for dealers to stock numerous used cars any time of the year.

In 2022, vehicles aged between 3 and 6 years collected a significant share, while those aged 7 to 10 years were lower. Check the table below:

| Vehicle Age | Number of Units | Percentage Sales |

| 3 and 6 years | 6.44 million | 40.2% |

| 7 to 10 years | 3.15 million | 19.7% |

| Above 10 years | 1.62 million | 19.7% |

In 2023, auto sales grew by 12% on overseas demand when China sent 160,000 more used cars to overseas countries. These numbers show that China’s automotive market is growing fast, creating a need to dispel older vehicles from the domestic market in favor of new ones. However, it’s important to note that mileage and condition are paramount when buying a used car from China.

Determine Your Used Car Model and Budget

When buying your first used car from China, determine the features you need. All you have to do is think about the number of people or the types of goods you regularly transport. For instance, if you’re purchasing a family car, you may need a vehicle with three-row seating to ensure comfort for all members.

Besides choosing the features, you must also determine your budget, keeping in mind that after the dealer ships your car to the nearest port, you’ll pay the customs duty.

Find the Correct Dealer

Before purchasing a used car from China, ensure you have the right dealer. A reputable car dealer will be willing to answer all your questions, and their job execution should be precise to you. Here are the steps to ensure you have the right dealer:

(i) Research the Dealer’s Background

Online search is the ideal way to find dealers in China, especially from overseas. Most dealers have professional websites and social media pages; therefore, checking their background is easier. In this case, gather information about their business, including registration details, online presence, and contacts.

(ii) Verify Credentials and Licensing

After researching the background, verify that the seller possesses the necessary credentials and licenses for international auto trade. Ideally, request their licensing information and cross-check with the official databases to ensure their legitimacy.

(iii) Assess Business Reputation

Evaluate the seller’s reputation within the industry to ensure their commitment to ethical practices and customer satisfaction. The process is simple: seek out reviews and feedback from previous customers to gauge their reliability by visiting the social media pages, the website, and Google reviews.

Investigate the Vehicle

Gather detailed information about the vehicle model you intend to purchase. This process is critical, and you can carry it in two ways:

1. Inspect the Vehicle In-Person

Visit the dealer’s location in person. Inspecting the vehicle in person will enable you to establish a direct relationship and better understand the dealer’s operations.

2. Utilize Third-Party Inspection Services

Alternatively, consider a third-party inspection company to help you complete the process. Professionals from a reputable third-party inspection company can perform an unbiased and comprehensive inspection to ensure you have an accurate assessment of the vehicle’s condition.

Here are the key activities to perform:

(a) Review Vehicle Documentation

Request the car’s history, maintenance records, and any relevant certifications, including the title and registration papers. Ensure that the information aligns with the seller’s claims to avoid potential misrepresentation.

(b) Check the Exterior

Look at the car’s sides to determine the quality of the paint. Also, check the tires for wear or misalignment and inspect the exhaust system and the undercarriage for corrosion and other damages.

(c) Look Under the Hood

The engine is the heart of the car, so you must ensure it’s in good condition. After inspecting the engine block, check the hoses and belts for damage. If you’re purchasing an electric car, ensure the battery and the motors are in good condition; an expert should conduct this inspection.

(d) Inspect the Interior

Check the car seats and upholstery for tears and stains. Then, switch on the accessories, such as the radio and AC, to determine if they are functional.

(e) Test Drive the Vehicle

Drive with one of the dealership’s professionals so you can ask them questions about the vehicle. Note the engine performance and other systems’ responsiveness during the test drive.

Finalize the Purchase Process

Once you have tested the vehicle or received the assessment report from your truncated inspection company, negotiate the price with the dealer, depending on the quality. Here are additional activities to carry out before importing your used car from China:

1. Verify Custom Duties and Taxes

Verify the customs duties and taxes applicable to car importation in your country. Understanding these financial obligations prevents potential delays and saves you from unplanned expenses.

2. Verify Shipping and Delivery Details

Most car dealers include the shipping costs to ensure you have an easy time bringing your dream car to your location. However, if your used car from China is being shipped internationally, confirm the shipping method, estimated delivery time, and other details such as insurance coverage.

3. Opt for Secure Payment Method

Nowadays, digital payment methods help trace the payment details in case issues arise. Regardless of finding a reputable dealer, use secure and traceable payment methods. Escrow services are ideal for huge investments to ensure you dont risk your money.

Buying a Used Car Is Easy with GuangcaiAuto

Buying a used car from China, even for the first time, is easier with GuangcaiAuto because we ensure customer satisfaction throughout the process. We have various vehicles from different manufacturers to ensure you get the most suitable unit. Additionally, we have a reliable inspection team that consistently provides excellent quality control. Contact us now for proper guidance on purchasing a used car from China.

Why You Should Choose a Chinese Electric Car As Your Next Drive

China is indeed becoming an emperor of electric vehicles; if you stood and claimed ten years back that China would rule in electric car production, purists would refer to your claims as nonsensical. Fast-forward to 2024, and China is indeed leading with 28% year-over-year electric car sales growth, according to a report by Counterpoint Research.

The misconception about China’s low-quality drives is no longer there. To clear the doubt, China leads high-tech research in 80% of critical fields (37 of 44 technologies), as reported by various sources, including Statista. Here are the top reasons your next drive must be from China:

Chinese Electric Cars Are Affordable Due to Government Support

The Chinese government plays a critical role in pushing electric car manufacturing and sales. It has heavily invested in this, with subsidies for manufacturers, consumer incentives, and charging infrastructure investments.

The government had coaxed buyers and manufacturers into the electric vehicle market through subsidies for nearly a decade. While many thought the end would come in December 2023, the government announced that EVs and other green cars will continue to be exempt from purchase tax in 2024 and 2025. It was also announced that the rate will be halved for 2026 and 2027.

The government’s subsidy move has enabled Chinese electric car manufacturers to offer vehicles at lower prices than their Western counterparts. Manufacturers have claimed the subsidy has helped reduce labor and manufacturing costs, saving finances for more research and technological advancement.

Below is a comparison of China’s and Western countries’ EV prices:

| China | USA | Europe | |

| Current EV Prices compared to 2015 | 50% reduction | 12.5% increase | 17% increase |

| Current EV and Petrol car prices | 33% cheaper than Petrol cars | 27% higher than petrol cars | 43% higher than petrol cars |

The Advanced Technology

Chinese companies are at the forefront of several key EV technologies, including battery technology, which accounts for 40% of the electric vehicle price. According to statistics released by market research firm SNE Research, CATL, BYD, CALB, Gotion, EVE, and Sunwoda are among the top 10 leading firms in global battery technology.

Chinese batteries have a cumulative technological, market size, and industrial chain advantage. That’s why, at the start of 2023, German automobile manufacturer Volkswagen sent nearly 300 employees to Chinese battery manufacturer Gotion to learn about battery manufacturing. The company wanted to learn about the chemical formulation and battery pack assembly.

Chinese automakers’ heavy research has led to breakthrough accomplishments in other automotive technologies, such as autonomous driving. Autonomous and semi-autonomous cars have showcased excellent safety technologies, such as auto braking, keeping on the lane, lane departure warning, and automatic parking systems.

Strong Domestic Market Fuels Improvements

Chinese citizens’ high demand for electric cars also benefits manufacturers and overseas consumers. Manufacturers continuously improve their products based on local consumer feedback, which enables them to market perfect brands overseas.

Generally, the improvement from local consumer feedback has enabled companies to achieve economies of scale. These economies of scale have also enabled engineers to carry out customization processes to release cars that meet different global consumer demands. As of 2021, China’s modification and customization market was valued at $10 billion and is expected to reach $31.2 billion by 2025.

According to the World Economic Forum, Chinese electric car consumers are overwhelmingly willing to consider a domestic model over models from other countries. Check the results of the study conducted on 1000 citizens of China, Europe, and the United States below:

| China | USA | Europe | |

| People who would choose their domestic EV models | 97% | 35% | 43% |

| People who would choose EVs from China | 97% | 35% | 25% |

China Offers a Variety of Car Options

China has a well-established automotive manufacturing industry, hence its ability to produce vehicles in a high volume. As such, China has some of the most common electric vehicle manufacturers, including BYD, NIO, Chery, and Geely.

The large manufacturing capacity is one of the main reasons for the variety of car options in China, with various features that suit different consumers. Technological advancements like automation in manufacturing and assembly mean that China can manufacture cars on a massive scale quickly. This gives the country’s automotive industry a competitive advantage because it responds fast to market demands.

China surpasses the combined car production numbers of the United States and the European Union. Below is a comparison of car production numbers in China, the USA, and Europe.

| Country | Sales share | Number of EV Charging points | EV score out of 10 |

| China | 58% | 2.7 million | 7.7 |

| USA | 18.2% | 168,300 | 6.55 |

| Europe | 13.9% | 632,423 | 5.4 |

The Chinese EV industry plans to expand further and retain its position as the leading EV manufacturer by building several EV charging stations in Central Asia and other continents.

GuangcaiAuto is China’s Best Electric Car Dealer

GuangCaiAuto is China’s best electric car dealer with over a decade of experience in car export trading. Our services remain top-notch for the following reasons:

1. Quality Assurance

GuangcaiAuto has the best car inspection team to ensure excellent quality control. After receiving cars from manufacturers or second-hand sellers, professionals inspect them for quality. Faulty units go through revisions to ensure zero errors upon entering the showroom for sale.

2. Wide Range of Electric Car Options

GuangcaiAuto has partnered with several electric car manufacturers in China to ensure they have the most suitable units in their 200 stores and 10000㎡ warehouses. Whenever you set foot at the headquarters in Guangzhou, the capital of Guangdong Province, rest assured you’ll drive home with your dream car.

3. Affordable Units

GuangcaiAuto is your go-to partner even when sourcing your dream ride on a budget. The government subsidies have led to the rise of a wide range of manufacturers, creating high competition. This reduces the cost of electric vehicles in China compared to other countries. Guangcai Auto also understands a car investment can take years of savings, hence setting reasonable prices for buyers.

4. Smooth Shipping Processes

Time is of the essence, and we understand you want to receive your electric car promptly after the payment. Our shipping team also inspects the vehicle and ensures proper packaging to avoid damage during shipping.

Contact our experts now for proper guidance on purchasing an electric vehicle from China. We always have a comprehensive supply to meet every customer’s needs.

About Denza: Luxury EVs for a Sustainable Future

When it comes to EVs, the Chinese EV manufacturer BYD has always been one of the dominating contenders in the global market. However, they decided to do something to set themselves apart in 2010 – making a joint venture with the German luxury car giant Mercedes-Benz, called Denza.

This brand was focused on making premium electric vehicles for the market. This article delves into the company as a whole, exploring its origins, offerings, and its potential for disrupting the luxury EV market on a global scale.

Formation of Denza: A Strategic Partnership

The Denza partnership between BYD and Mercedes was a stroke of genius. For instance, BYD has always been known for its prowess in electric vehicle tech and battery manufacturing. On the other hand, Mercedes-Benz contributed its design language, technological expertise, as well as brand name to the table.

Initially, shares were distributed equally between the two partners. Nevertheless, in 2021, Mercedes reduced its stake to 10%, allowing BYD to take over completely. This reflects the shifting dynamics in the EV market, with Chinese manufacturers increasingly taking the lead.

The Early Days: Concept to Production

In 2012, Denza entered the market with a concept car – an electric luxury automobile that hinted at their brand’s aspirations. However, it wasn’t until 2014 that Denza introduced its first production model, the Denza EV – a plug-in hybrid electric vehicle (PHEV) based on the BYD Tang platform.

The Denza EV 500: Blending Luxury and Sustainability

The launch of the Denza EV 500 was more than just about premium aesthetics; it underscored a commitment to environmental preservation. This model incorporated many green ideas prevalent among top carmakers who were launching their own “green” divisions. Initially, the Denza EV 500 was sold only in select cities in China, laying the groundwork for Denza’s future initiatives.

BYD Takes Control and Expands the Lineup

The year 2021 marked a significant turning point for Denza. During this period, BYD restructured the joint venture, gaining control and capitalizing on its advancements in battery technology and EV development.

The Denza X SUV

In 2019, the Denza X SUV was introduced, marking the beginning of the Denza dynasty. This PHEV combined performance, spaciousness, and a luxurious interior, making it an appealing choice. Significant updates were made to the Denza N8 in 2022, which was previously known as the Denza X.

The Denza D9: Entering the Luxury MPV Segment

Denza didn’t limit itself to popular SUVs. In 2022, the brand announced the Denza D9, a luxurious MPV designed for families who prioritize comfort and space, especially during business trips. This bold move signaled Denza’s ambition to challenge established players like the Lexus LM in the high-end minivan category.

Global Ambitions: The European Debut

Denza made a notable entry into Europe with the D9 at the Paris Motor Show. This strategic move positions the company to tap into the growing demand for premium electric vehicles in Europe.

Looking Ahead: Denza’s Vision for the Future

Denza has a promising future with BYD’s support and plans for more upcoming models. Here’s what to expect:

(1) Cutting-Edge Technology

BYD’s advancements in battery technology are a key differentiator. Denza vehicles are likely to feature increased range, faster charging times, and innovative features that enhance the driving experience.

(2) Expanding the Model Line-Up

Following the success of the N8 and D9, Denza is expected to diversify its offerings to cater to various market segments. This could include sedans, sports cars, or even electric pickups.

(3) Focus on Design and Luxury

The fusion of German design sensibilities with BYD’s emphasis on quality ensures a luxurious ownership experience. We can expect Denza cars to continue offering premium interiors, avant-garde materials, and a passenger-centric approach.

Challenges and Opportunities

Operating in a competitive landscape dominated by established luxury brands, Denza faces several challenges, including:

(1) Brand Recognition:

As a relatively young brand, Denza is still establishing itself globally. Effective marketing campaigns highlighting their unique selling points will be crucial in building brand awareness among luxury car buyers.

(2) Charging Infrastructure:

Reliable charging infrastructure is essential to alleviate range anxiety for EV owners. Denza is addressing this by leveraging partnerships and the expanding global charging network.

(3) Competition:

The luxury EV market is increasingly crowded, with established players like Tesla, Audi, and Mercedes-Benz competing for market share. Denza must continue to innovate and differentiate its offerings to stand out.

Conclusion: Denza’s Potential for Market Disruption

Denza’s agility as a young brand enables it to adapt quickly to evolving market trends and consumer preferences. Coupled with BYD’s battery technology, Denza has the potential to become an attractive option for cost-conscious luxury car buyers. Their focus on high-end yet environmentally friendly vehicles positions them well to drive the adoption of EVs.

Denza is just beginning its journey. With BYD’s backing and a renewed focus on global expansion, the brand is poised to dominate the premium EV segment. Their commitment to design and sustainability gives them a distinct advantage in disrupting the traditional luxury car market. As the world embraces electric mobility solutions, Denza is well-positioned to lead this transformation.

For those interested in buying Denza cars internationally, visit our website! We have you covered.

China Cars in Nigeria: Transforming the Automotive Market

Nigeria, the largest economic region, has witnessed an exceptional automotive revolution in the past years. The primary reason behind this is the successful introduction of popular Chinese car brands into the Nigerian landscape, which has brought Nigeria’s road to the next level. Car traders in Nigeria are prioritizing Chinese brands over other international car brands because of their sleek, spacious designs, innovative & advanced features, fuel efficiency, affordability, and other suitable features. They are continuously becoming a popular choice among Nigerian buyers and have strengthened their position in the Nigerian automotive industry.

If you are curious to know about the rising popularity of Chinese cars in Nigeria, then stay right here. This article will discuss advanced and innovative features that are becoming prominent in Nigeria. Additionally, we will also explore the famous car brands of China that are captivating the attention of Nigerian traders by running their car models on the roads of Nigeria and comparing Chinese car brands with cars of famous international brands.

Advanced Technology and Innovative Features of Chinese Cars:

The Chinese cars are greatly equipped with advanced and innovative cutting-edge technologies that have not only made them popular among Chinese traders but also made them capable of making waves on the roads of Nigeria. Let us uncover the technologies and features of Chinese car brands that make them capable of producing a strong position in the Nigerian automotive industry.

Cost-effective Option:

The cost of Chinese cars is lower than that of international car brands. Despite the low price, the Chinese do not compromise the quality of their automobiles. Thus, affordability makes Nigerian traders capable of investing in high-quality vehicles at an affordable cost.

Modern & Sleek Designs:

Chinese engineers are gaining excellence in every manufacturing industry, with no exception for automobiles. They manufacture cars with modern and sleek designs with their exceptional skills and expertise. Such designs captivate the attention of the traders on the roads of Nigeria, making them the best option when it comes to cars with unique, captivating designs.

Fuel Efficiency:

One of the reasons for the increasing demand for Chinese cars in Nigeria is that they are fuel-efficient. It means that they operate with very little fuel consumption. The low fuel consumption is because they have fuel-efficient engines. Usage of less fuel also proves cost-effective as it helps in saving money.

Comfort & Convenience:

Chinese cars commonly feature rearview cameras, heated seats, automatic climate control, and other convenient features. They offer great comfort and convenience while driving on Nigeria’s roads, making them the best choice among the traders of Nigeria.

Durability & Reliability:

Chinese cars are exceptionally durable and reliable. The vehicles are manufactured with advanced manufacturing techniques using notch-quality parts under the strict supervision of experienced manufacturers. They ensure the long-term functioning of cars and prevent damage under any conditions. It boosts their reliability among Nigerian traders

Modern Infotainment Systems:

The Chinese cars are equipped with modern entertainment systems. These include smartphone integration, Bluetooth connectivity, touchscreen displays, and other systems, making them a striking option in Nigeria.

Hybrid & Electric Options:

Chinese cars featuring hybrid and electric options are among the major reasons for their increasing popularity in Nigeria’s landscape. These options help reduce the emission of toxic gasses, especially carbon, during the cars’ working. Thus, it enhances the eco-friendliness that prevents the environment of Nigeria from being polluted, increasing its value in Nigeria’s automotive market.

Besides the above-discussed innovative options, Chinese cars also possess advanced features such as safety features, internet connectivity, etc. These combined features make the Chinese car brands unique over the other international car brands and increase their value at the global level.

Popular Chinese car brands in China:

There is a wide range of Chinese car brands that are currently operating in Nigeria and garnering attention with their well-designed car models featuring excellent features. Look at the famous Chinese car brands partnering with Nigerian traders and allowing their cars to run speedily on Nigeria’s roads.

1- Geely

Geely Auto Group is a globally recognized automobile manufacturer in China that has been working since 1997. Its major car models include the following:

SUV: MONJARO, COOLRAY, NEW COOLRAY, etc

SEDAN: EMGRAND

EV: GEOMETRY E

Its car models feature advanced safety features, modern designs, spacious interiors, fuel-efficient engines, and affordability, making them a great option among the traders of Nigeria.

2- Changan Auto

CHANGAN AUTO is the oldest state-owned manufacturer in China, manufacturing a wide range of cars. Its dominant car models include the Raeton CC, Eado XT, Eado, Eado DT, and Alsvin. Its cars feature excellent quality, innovative and spacious designs, fuel-efficient engines, and sustainability and are supported by intelligent driving, intelligent interaction, and intelligent networking.

3- GAC Motors

GAC MOTORS is a leading manufacturer in China, founded in June 1997. It is working globally and introducing its vehicle in different countries, including Nigeria. Its top car models include the following:

SEDAN: GA6, GA7, GA4

SUV: GS3, GS3, POWER, GS8, GS4, GS5, etc

These cars mainly feature modern designs with advanced safety features and modern infotainment systems, making them the best for Nigeria’s roads.

4- Guangcai AutomobTrading Co., Ltd.

Guangcai Auto is one of the best car suppliers and business partners in China. They are reliable, transparent, and flexible, offering high-quality, customized vehicles on time. They maintain strong communication, technical expertise, and financial stability, backed by robust networks. The company prioritizes customer satisfaction and provides excellent after-sales service at competitive prices.

Guangcai Auto is committed to innovation and environmental responsibility; they comply with international standards and respect cultural differences, earning a positive industry reputation.

What you can get from Guangcai Auto:

1. Competitive Pricing:

Lower vehicle costs are due to reduced manufacturing and labor expenses.

2. Wide Range of Models:

Diverse selection, including budget, electric, luxury, and commercial cars.

3. Customization Options:

Flexibility in modifying vehicles to meet specific customer needs.

4. Quality Improvement:

Adherence to international standards and certification availability; integrated international shipping and logistics processes.

5. After-Sales Service:

Comprehensive warranties, maintenance, and parts availability, and reliable connections with local and global manufacturers.

Comparison of Chinese Car Brands with International Car Brands

Chinese car brands are prioritized in Nigeria, comparable to the popular international car brands. Let us compare the Chinese car brands with international ones in the table form for a clear understanding.

| Main Features | Chinese Cars (Geely, Changan Auto) | International Cars (Volkswagen, Honda, Toyota) |

| Prices | Cost-effective option | Expensive |

| Design | Ideal for Nigerian roads | Less suitable for Nigerian road |

| Spare Parts | Affordable, Readily available | Expensive, Scarce |

| Electric Options | Affordable options | Limited options |

| Maintenance Cost | Low cost | The High-Cost |

Future of Chinese Car Brands in Nigeria:

With the increase in trading and demand for Chinese cars in Nigeria, it is obvious that Chinese cars have a promising future in the automotive industry of Nigeria. This is primarily due to the growing popularity of Chinese brands, enhanced demand for cost-effective vehicles, and expansion of Chinese automakers in Nigeria.

The Nigerian trader may face some challenges, including high import taxes and duties, demand for better after-sale services, infrastructure limitations, etc. Despite these challenges, it is predicted that there will be an increased entrance of Chinese automakers into Nigerian markets, so the Chinese brands will continually gain market share.

The existing brands of China will expand their product offerings in Nigeria. Additionally, electric vehicles may gain more popularity. The success and expansion of Chinese car brands not only help promote Chinese car brands but also play an important role in shaping the automotive industry in Nigeria.

China Cars In Ethiopia

Ethiopia needs affordable transportations options. Ethiopia’s car market has always been unpredictable, with used cars dominating for many years. China in this regard seems to be the best option in terms of affordability.

High import taxes, combined with economic difficulties, have created significant obstacles for many individuals seeking to purchase new cars. Moreover, both new and used car sales have experienced a considerable uptick, as reported by Mordor Intel.

- One of the hurdles stalling market growth has been the imposition of exorbitant import taxes.

- Taxes have elevated new cars to a status of luxury, placing them beyond the financial grasp of many prospective buyers.

- Finding spare parts and reliable after-sales service has been a significant challenge for keeping cars running smoothly.

Despite facing various obstacles, Chinese car manufacturers have successfully captured the interest and purchasing power of Ethiopian consumers.

Renowned brands such as BYD, Chery, and Geely have cemented their presence by offering affordable yet feature-packed models.

Notably, vehicles like the BYD F3 and Geely Emgrand are gaining traction, owing to their attractive blend of cost-effectiveness and dependability.

Chinese Automobile Market in Ethiopia

The Ethiopian government has implemented appropriate trade liberalization policies OR Chinese car import regulations in Ethiopia in order to encourage Investor flights and low cost new vehicles. Some of these are the reduction of import duties on new and used vehicles, especially new cars, as well as offering fiscal incentives such as tax credits for the purchase of EVs.

The current government of Ethiopia recently liberalized the rules for import of EV parts with no duties to encourage the use of green transport. This policy change seeks to make a new generation of vehicles, particularly electrically powered models more accessible to the Ethiopian customer.

Several factors have contributed to the increased importation of Chinese cars to Ethiopia, these factors entail; shifts in trade relations, changes in policies concerning trade, investment by the Chinese automobile companies, and changing market demands for affordable and differentiated car models.

Why buy Chinese cars in Ethiopia

- Affordability: The Chinese cars also cost relatively lower than the Japanese, American or the European cars and hence are affordable to more people. This cost is quite appealing to the Ethiopian customers who desire cheaper transport means and services.

- Advanced Features: While most Chinese cars are cheaper compared to the likes of Toyota, they also contain modern trappings that will attract informed consumers. Such aspects include safety, entertainment, and powertrain management in a manner that makes them offer a good package in the market.

- Improved Quality and Perception: Quality of cars manufactured by Chinese automakers has enhanced greatly and social and economic issues earlier felt regarding reliability and durability are less of a concern now. Some of the brands that are currently dominating the market include BYD, Chery, and Geely; these car makers have over time greatly improved the quality of their cars and thus placed confidence with the Ethiopian consumers.

Chinese cars offer an appealing alternative in Ethiopia’s diverse and evolving market, as European luxury sedans struggle to cater to the masses.

What Chinese car brands are in Ethiopia?

Ethiopian consumers have been a target of Chinese car manufacturers in particular due to the following reasons. Some car makers of this caliber include BYD, Chery and Geely set models that are not only affordable but contain most of the gimmicks.

- BYD: With electric and plug-in hybrid automobiles, BYD has been steadily increasing its market share in Ethiopia with some of its models including BYD F3 and BYD Tang which are widely known for their affordable prices and new generation features.

- Chery: This is a state owned automobile manufacturing company which deals with production of various models of cars mainly/passenger cars and SUVs. These include models like the Chery Tiggo and other cars have started to make their way into the Ethiopian market because they are very reliable and the cost of maintaining them is very cheap.

- Geely: Companies like Geely, the owner of Volvo and Lotus, set heart into their affordable automobiles yet equipped with numerous functions. New generation vehicles are some of the Automobiles that have flooded the Ethiopian market and some of the popular models include the Geely Emgrand.

These brands are not only emerging to compete regarding the prices they offer but also because the middle-income earners of Ethiopians are also considered to get value for the quality and features offered on these brands. Furthermore, the Ethiopian government has set policies that require people or companies to use more fuel-efficient cars, and this is something that falls squarely within the domains of those Chinese car makers.

What is the best selling car in Ethiopia?

Recently, Toyota Hilux is ranked among the most Popular Chinese-made car models in Ethiopia. The Toyota hilux has been known in the market as a very popular model mainly because of factors such as durability, reliability and versatility that the car gains from due to its usability in both urban and rural areas.

Due to the strength of the material that has been used in its construction and the ability of getting spare parts in most places in the country, people tend to like it. It is widely employed in such segments owing to its versatility, such as agriculture, construction, government and NGOs use and purchase, and other segments.

Another highly popular model at the moment is the Toyota Corolla. Specifically, the ninth generation Corolla and other generations such as the tenth, eleventh generations of the car (models 2000-present) are some of the most frequently spotted vehicles in Ethiopia.

They are preferred because of their efficiency and affordable prices and as a result, many of them are noticed on the Ethiopian roads as mentioned in “All About Ethiopia”.

Local Chinese manufacturers are also penetrating the market with the likes of BYD and Chery, with the BYD F3 and Chery Tiggo now fairly common owing to their affordability and compared to other cars in their class can be considered quite contemporary.

Cost of Chinese cars in Ethiopia

The cost of Chinese cars in Ethiopia can vary significantly depending on the make, model, and features of the vehicle. Here’s an overview of some common Chinese car brands and their prices in Ethiopia:

- BYD Yuan Up Single Motor: Approximately 750,400 ETB.

- BYD Yangwang U7 (2024): Approximately 7,840,000 ETB.

- Geely Panda Knight Luxury: Approximately 616,000 ETB.

- Dongfeng Nammi 01 EV: Approximately 582,400 ETB.

- MG Cyberster 100th Anniversary Edition: Approximately 3,904,880 ETB.

These prices illustrate the range from more affordable models like the Geely Panda to more high-end options like the BYD Yangwang U7.

Electric cars, which are becoming increasingly popular in Ethiopia due to government incentives and tax exemptions, can range from around 500,000 ETB to over 2,000,000 ETB for various models.

This shift towards electric vehicles is part of Ethiopia’s broader strategy to adopt eco-friendly transportation solutions.

Future of Chinese cars in Ethiopia

The Ethiopian government has set a bold target to deploy nearly 500,000 electric vehicles (EVs) over the next decade, significantly advancing its shift towards sustainable transportation.

Initially, the plan includes importing around 148,000 electric vehicles and 48,555 electric buses.

This ambitious strategy is part of a broader ten-year plan, which is expected to be achieved well ahead of schedule, prompting the government to revise its target to 439,000 EVs by 2030.

● Government Incentives

To encourage this change the Ethiopian government has enforced the following incentives; These are; importation of parts for assembly, free taxes, a 5% tax on parts that are partially assembled EVs and a 15% tax on fully assembled EVs. These incentives are intended to make electric vehicles more attractive than gasoline vehicles because the latter attracts high import taxes.

● Economic and Environmental Benefits

Minister of State for Transport and Logistics, Barreo Hasen, pointed out the position of economics in considering this change, relying on the fact that it will save large amounts of foreign currency, which Yemen spends on importing fuel. The Ethiopian government alone consumed about $6 billion for fuel in the year 2023 out of which over fifty percent was utilized for fuel-powered automobiles. Moreover, the change in the vehicle type to those that are electric has the potential of decreasing pollution within urban areas tremendously.

● Private Sector Involvement

The government’s push for EVs has also spurred private sector engagement. Companies like Belayneh Kindie Metal Engineering Complex are now assembling electric mini buses locally, using components imported from China. For instance, China’s King Long supplies parts for electric mini buses and larger buses, catering to Ethiopia’s growing demand for EVs.

Besufekad Shewaye, general manager of Belayneh Kindie Metal Engineering Complex, said in an interview that Ethiopia’s rich hydropower resources provide a solid foundation for the country’s electric vehicle market. Starting from mid 2023, the company has commissioned and fed 216 electric mini buses into the Ethiopian market and has marketed half of these products to the transportation service providers and government agents.

These developments show potential to grow the automotive industry in Ethiopia in the next coming years with due emphasis on electric vehicles in order to reduce fuel importation and environmental degrading effects.

Used Car Export Guide (2023) – Kyrgyzstan

(1) Basic situation

The Kyrgyz Republic (shortened as Kyrgyzstan) is located in Central Asia, bordering Kazakhstan to the north and adjacent to China to the east. Its capital is Bishkek, with a land area of approximately 199,900 square kilometers and a population of 7.2 million people. According to data from the National Statistical Committee of Kyrgyzstan, the country’s GDP in 2023 was $13.98 billion, with a year-on-year growth of 6.2%, and the per capita GDP is about $2,000. According to data published by the Chinese Customs, China remains Kyrgyzstan’s largest trading partner. The total trade volume between China and Kyrgyzstan in 2023 reached $19.8 billion, an increase of 27.8% compared to the previous year. Among them, Kyrgyzstan’s exports to China amounted to $831.8 million, an increase of 30% year-on-year, while China’s exports to Kyrgyzstan were $19.72 billion, up 27.2% year-on-year.

In terms of cooperation, in May 2023, the two sides signed a joint declaration to establish a new era of comprehensive strategic partnership, deepening the partnership. On October 25, 2023, the governments of both countries signed a plan for cooperation in adjacent areas, actively promoting cooperation projects in trade and investment, cross-border transportation, port construction, agriculture, energy, and other fields.

Kyrgyzstan’s natural resources mainly include gold, antimony, tungsten, tin, mercury, uranium, and rare metals. Among them, it ranks third in the world in antimony production and first in the CIS, second in tin and mercury production in the CIS, and third in hydropower resources among CIS countries.

(2) Automobile market conditions

Kyrgyzstan is a left-hand drive country with a relatively weak domestic automotive industry, heavily reliant on imports, especially second-hand vehicles, with a high market share of Japanese brands. Since 2022, there has been a significant increase in automobile imports to Kyrgyzstan.

According to reports from the Kyrgyzstan Economist website, from January to October 2023, Kyrgyzstan imported a total of 143,000 passenger cars, with imports totaling approximately $2 billion. China has become its largest supplier of automobiles, exporting 44,720 vehicles with a transaction value of $688 million.

According to statistics from the Chinese Ministry of Commerce, China exported 71,000 used cars to Kyrgyzstan in 2023. Currently, Chinese automobiles imported into Kyrgyzstan are mainly used for re-export to the Russian market, driven by the huge demand in the Russian automotive market. The local demand for imported vehicles in Kyrgyzstan still has untapped potential.

The capital of Kyrgyzstan, Bishkek, has long been rated as one of the most polluted cities in the world. To address this issue, Kyrgyzstan is actively promoting the development of the new energy vehicle industry. On one hand, it encourages consumers to use electric vehicles by offering preferential import rates for electric cars.

On the other hand, it actively encourages Chinese electric vehicle companies to establish manufacturing plants domestically. However, Kyrgyzstan has only about 30 charging stations nationwide, most of which are located in the capital, Bishkek. Additionally, the country faces energy shortages due to insufficient power generation capacity. The lack of charging infrastructure and energy shortages are the main obstacles hindering the development of Kyrgyzstan’s new energy vehicle industry.

(3) Used car import policies and regulation

1. Import policy

Kyrgyzstan only allows the import of left-hand drive vehicles, with imported used cars not exceeding 10 years in age and meeting at least Euro 2 emission standards. Imported vehicles are subject to inspection. Imported vehicles are classified into temporary and permanent imports. Temporary imports, including motorcycles, must be exported at the end of the agreed period. Kyrgyzstan encourages the import of low-age used cars, imposing higher tariffs on used cars older than 7 years.

2. Tax policy

Temporary import vehicles are subject to a 3% value-added tax and a monthly fee of 0.15% of the contract amount.

Permanent import vehicles are subject to customs duties and value-added tax (VAT). The customs duty is determined based on the age and engine displacement of the vehicle, with the duty being inversely related to the age:

- 1. Vehicles aged less than 3 years are classified as new cars. Customs duty ranges from 10% to 15% of the vehicle’s cost price, depending on the engine displacement.

- 2. Vehicles aged 3-7 years incur a customs duty of 20% of the vehicle’s cost price or a duty based on the vehicle’s specific age, ranging from 0.36 to 0.80 euros/ml. The higher duty between the two options is applied as the import duty.

- 3. Vehicles older than 7 years incur a customs duty ranging from 1.4 to 3.2 euros/ml. Kyrgyzstan’s import VAT for used cars is 12% of the vehicle’s customs price.

- 4. Regarding new energy vehicles, the Eurasian Economic Union region maintains a zero tariff policy for the import of pure electric vehicles until 2025. Kyrgyzstan allows tax-free import of 10,000 new energy vehicles annually and offers tariff incentives for hybrid vehicles.

3. Documents required for import

Original ownership and registration certificates

Original invoice

Driver’s license and international insurance certificate

Bill of lading

Copy of passport

Copy of visa

Original bill of lading (OBL) / air waybill (AWB)

Original technical passport with cancellation mark

Letter of employment

Customs commission letter

If you want to import cars from China, you are welcome to contact us.

Guidelines for Exporting Electric Vehicles from China

Chinese cars are becoming more and more popular in the world, and more and more people are engaged in the business of exporting electric vehicles from China. Below are the guidelines for exporting electric vehicles from China.

Industry Information

On March 28th, Xiaomi Group held a launch event for the listing of Xiaomi Automobiles in Beijing. The Xiaomi SU7 was officially unveiled, and it immediately sparked a sales frenzy in the electric vehicle market. Orders surged rapidly in a short period of time, with crowds gathering at delivery sites, creating unprecedented excitement.

In addition to its popularity in the domestic market, videos testing and reviewing the Xiaomi SU7 have been circulating on overseas platforms such as TikTok and YouTube. Especially notable is its appearance on TikTok in Russia, where local dealers promote it to affluent customers, collecting pre-orders from the Russian market.

According to data released by the General Administration of Customs, in 2023, over 5.22 million Chinese cars were sold overseas, surpassing Japan for the first time and making China the world’s largest exporter of automobiles. In the first quarter of this year, Shanghai alone exported 529,000 vehicles, a year-on-year increase of 30.7%.

Chinese export automobile tariff rate

What are the car tariffs?

The car tariff depends on the landed price of the vehicle. Different brands and models have different landed prices, so the amount of the car tariff varies. Currently, the car tariff in China is 25%, which means the tariff amount is 25% of the landed price of the car.

Additionally, CIF is not the base price of the car; it includes the sea freight and insurance costs on top of the original price. For example, if a car has an original price of 100,000 yuan, with sea freight of 20,000 yuan and insurance of 10,000 yuan, then the tariff would be calculated as follows: (100,000 + 20,000 + 10,000) × 0.25 = 32,500 yuan.

How are car tariffs calculated?

Generally, the comprehensive import tariff for automobiles includes the basic tariff (25%), value-added tax (17%), consumption tax (10%-40%), and other taxes, totaling around 120%.

So, in addition to the 25% basic tariff, automobiles are also subject to value-added tax, consumption tax, and other taxes. The value-added tax rate is 17%, while the consumption tax rate ranges from 10% to 40%. The specific rates of other taxes and the ratio of value-added tax depend on the displacement of the vehicle.

Tariffs are a type of national tax levied by customs on goods and items entering or leaving the border. The tariff rate varies depending on the country and includes customs duties, value-added tax rates, and tariff thresholds.

Value-added tax (VAT) is a turnover tax levied on the value added during the circulation of goods (including taxable services). VAT imposed at the import stage is collected by customs, while VAT at other stages is collected by tax authorities.

Tariffs and VAT standards for common trading countries

(1) United States:

Tariff rates range from 0% to 37.5%, with an average rate of 5.63%. The tariff threshold is $800 USD.

(2) Canada:

Tariff rates range from 0% to 35%, with an average rate of 8.56%. The tariff threshold is 20 Canadian dollars.

(3) Australia:

Tariff rates range from 0% to 10%, with an average rate of 4.6%. Value-added tax (VAT) and consumption tax are levied, with a consumption tax rate of 10%. The tariff threshold is 1000 Australian dollars.

(4) United Kingdom:

Tariff rates range from 0% to 17%. Electronic products such as laptops, mobile phones, digital cameras, and gaming consoles are exempt from tariffs. The standard VAT rate in the UK is 20%. VAT = VAT rate × (CIF value + import duty). The tariff threshold is £135.

(5) Japan:

Tariff rates range from 0% to 30%, with an average rate of 4.49%. Consumption tax = standard consumption tax rate of 8% × (CIF value + import duty). Consumption tax is only levied on alcohol, tobacco, and gasoline. The tariff threshold is 10,000 Japanese yen.

(6) Singapore:

Tariff rates range from 0% to 4%, with an average rate of 0%. VAT = VAT rate of 7% × (CIF value + import duty). The tariff threshold is 400 Singapore dollars.

(7) Malaysia:

Under free trade agreements, different countries are subject to different tariff rates, and consumption tax is replaced by sales and service tax. The sales tax rate is 10%, and the service tax rate is 6%. The tariff threshold is 500 Malaysian ringgit.

(8) Thailand:

Tariff rates range from 0% to 80%, with an average rate of 20.93%. Tariffs are exempted for products such as laptops and other electronic products. VAT = standard VAT rate of 7% × (CIF value + applicable tariff). The tariff threshold is 1,500 Thai baht.

(9) New Zealand:

Tariff rates range from 0% to 15%, with an average rate of 5.11%. VAT = standard VAT rate of 15% × (CIF value + applicable tariff + consumption tax). The tariff threshold is 60 New Zealand dollars.

(10) South Korea:

Tariff rates range from 0% to 40%, with an average rate of 4.17%. VAT = standard VAT rate of 10% × (CIF value + import duty + applicable taxes). The tariff threshold is 150,000 South Korean won.

(11) Germany, France, Italy:

Tariff rates generally range from 0% to 17%. Laptops, mobile phones, digital cameras, and gaming consoles are exempt from tariffs. The standard VAT rates in Germany, France, and Italy are 19%, 20%, and 22% respectively. The tariff threshold is 150 euros.

What procedures and precautions are required for exporting electric vehicles?

Notes on exporting electric vehicles by railway:

- All shipped electric vehicles have passed the safety inspection by the national appraisal institution. The vehicles being shipped are new and are either pure electric vehicles or hybrid vehicles.

- Except for the power batteries and storage batteries installed in the vehicles themselves, no spare batteries or other energy batteries are allowed to be carried. It is imperative to ensure that the charging level does not exceed 65% and provide real photos showing the charging level not exceeding 65%, as well as photos of the matching vehicle identification number (VIN).

- Ensure that the total power of the electric vehicles in the container is turned off.

- The goods name on the customs declaration, item list, and waybill must be completely consistent.

- Reinforcement detail photos (including details of the reinforcement of all four wheels).

- Only new cars can be transported, with a mileage not exceeding 100 km. The trade mode can be for used cars.

Seaborne export requires maritime record filing for electric vehicles:

Electric vehicles fall under Class 9 dangerous goods UN3171 in the International Maritime Dangerous Goods (IMDG) Code, as they are vehicles powered by lithium batteries. Therefore, for the export of electric vehicles, maritime filing must be done to declare them as dangerous goods before they can be shipped out normally.

The export of electric vehicles also requires the following documents:

Export License: Exporting electric vehicles requires obtaining an export license. For specific requirements and procedures, please consult the provincial-level (including municipalities directly under the central government) commerce authority in your location.

Customs Declaration Procedures: Exporting electric vehicles requires completing customs declaration procedures. For specific requirements and procedures, please consult the customs authorities in your location.

The following is a detailed description of the specific procedures for exporting electric vehicles:

Export License:

Exporting electric vehicles requires obtaining an export license. For specific requirements and procedures, please consult the provincial-level (including municipalities directly under the central government) commerce authority in your location.

Conditions for Applying for an Export License:

- The enterprise must have independent legal personality and be registered with the Ministry of Commerce.

- The enterprise must meet the operational requirements specified in the “Measures for the Administration of Export of Electric Vehicles.”

- The enterprise must have the operational and management capabilities suitable for exporting electric vehicles.

Documents Required for Export License Application:

- Copy of the enterprise’s business license.

- Identification of the enterprise’s legal representative.

- Proof of the enterprise’s operating premises.

- Qualifications of the enterprise’s personnel.

- Proof of the enterprise’s financial status.

- Trade contract signed between the enterprise and overseas customers.

- Inspection and qualification report for electric vehicles issued by a designated third-party institution.

- Vehicle Registration Certificate for the vehicles intended for export.

Customs Clearance Procedures:

Exporting electric vehicles requires completing customs clearance procedures. For specific requirements and procedures, please consult the customs office in your location.

Documents Required for Customs Clearance of Electric Vehicles:

- Export License

- Invoice

- Contract

- Bill of Lading

- Packing List

- Other relevant supporting documents

Import certification requirements for electric vehicles in some countries/regions

US DOT Certification and EPA Certification:

Entering the US market requires compliance with the US Department of Transportation (DOT) safety certification. This certification is not government-led but is self-tested by manufacturers. The DOT oversees certification for certain components such as windshields and tires. The remaining parts are subject to periodic inspections by the DOT, and any falsification is strictly punished. EPA environmental certification is similar to DOT safety certification, where manufacturers self-declare and are inspected by the Environmental Protection Agency (EPA).

EU E-mark Certification:

Exported vehicles to the EU must obtain e-mark certification for market access. This certification is based on EU directives and involves inspections regarding component approvals and vehicle systems under the EEC/EC Directive. After passing inspection, the product can use the e-mark certificate to enter the EU market.

Nigeria SONCAP Certification:

The SONCAP certificate is a mandatory document for products to clear customs in Nigeria. Without it, delays or rejection may occur. All regulated products covered under the SONCAP program, including automotive spare parts, must undergo inspection and comply with Nigerian national standards or recognized standards to obtain a Certificate of Conformity (COC).

Tanzania PVOC Certification:

Tanzania requires all regulated products covered under the Pre-Export Verification of Conformity to Standards (PVOC) program to undergo inspection. Products must comply with Tanzanian national standards or recognized standards to obtain a Certificate of Conformity (COC) for entry into the Tanzanian market.

Saudi Arabia SABER Certification:

SABER certification is part of Saudi Arabia’s product safety program launched in January 2019. It involves an online certification system for conformity assessment of exported products. Automotive components were included in the certification list in November 2019. The SABER certification process is similar to Nigeria’s SONCAP certification, where products must apply for PC certificates initially and SC certificates for each batch upon shipment.

Customs clearance rules in European countries

In today’s globalized era, international trade has become a crucial link connecting the economies of various countries, with customs clearance rules playing a vital role in this process. Europe, as one of the world’s most important trade regions, its trade activities are not only essential for the economic prosperity of Europe itself but also have a profound impact on the global economy.

EU customs clearance rules

The EU’s customs clearance rules include the influence of the Single Market and Customs Union, the EU Customs Union, as well as the main customs clearance documents and procedures.

1. The impact of the Single Market and Customs Union:

The Single Market:

The European Union’s Single Market is a unified economic area that eliminates tariffs and non-tariff barriers among member states. This means that goods, services, capital, and people can move freely within the European Union without the need for cumbersome customs procedures. This integrated market significantly simplifies trade processes, promoting cross-border trade and economic growth.

Customs Union:

The member states of the European Union form a Customs Union, unifying the tariff policies towards third countries. This means that a uniform tariff rate applies to goods imported into the European Union, regardless of which member state of the EU they enter. This integrated tariff policy reduces uncertainty in foreign trade and provides businesses with a larger market and more opportunities.

2. EU Customs Union:

EU Customs Union is an important institution aimed at facilitating trade circulation. It is committed to coordinating and harmonizing customs procedures among member states to ensure the efficiency and consistency of trade circulation across the entire EU. The EU Customs Union strengthens cooperation among member states through information sharing, training, and technical cooperation, enhancing the supervision and enforcement capabilities against customs violations.

3. Main customs clearance documents and procedures:

Single Window:

The EU adopts the Single Window system, simplifying the declaration process for cross-border trade. Companies can submit all necessary documents and information to all relevant departments with a single declaration, reducing redundant work and time costs.

EU Customs Code:

The EU Customs Code specifies the clearance procedures, declaration requirements, customs responsibilities, and other related aspects of import and export goods. It provides a unified legal framework for trade within the EU and with third countries.

Customs Cooperation Working Party:

This is an institution composed of customs officials from EU member states, aimed at coordinating and promoting customs cooperation within the EU and with third countries. The committee is responsible for developing customs clearance policies, resolving trade disputes, and promoting trade security.

German customs clearance rules

1. Overview of German customs system:

Germany’s customs system is managed and enforced by the Generalzolldirektion (General Customs Directorate) of the Federal Customs Administration (Bundeszollverwaltung). This agency is responsible for overseeing Germany’s customs procedures, including the declaration and inspection of goods for import and export, customs duties collection, and customs compliance reviews.

2. Classification and declaration requirements for import and export products:

Product Classification:

Imports and exports in Germany must be classified according to relevant commodity codes. Germany adopts internationally recognized product coding systems, such as the World Customs Organization’s (WCO) International Harmonized System (HS Code), to ensure consistency and standardization.

Declaration Requirements:

German customs requires the declaration of imported and exported goods to facilitate necessary tariff collection, regulation, and security checks. The declaration typically needs to include detailed descriptions of the goods, their value, quantity, country of origin, and other relevant information. This information is submitted through the relevant customs documents or electronic reporting systems.

3. German customs duties and import taxes:

Tariffs:

Germany, as a member of the European Union, participates in the EU’s Customs Union. Therefore, importing goods from other EU member states usually does not require the payment of additional tariffs. For imported goods from non-EU countries, Germany levies the applicable tariff rates according to the EU’s tariff schedule.

Import Taxes:

In addition to tariffs, Germany may also impose import taxes (such as value-added tax) on specific types of imported goods. The tax rate and scope of import taxes depend on the nature and value of the goods, and are levied in accordance with German tax regulations.

French customs clearance rules

In France, customs regulations are managed and enforced by the Directorate General of Customs and Indirect Taxes (Direction générale des douanes et droits indirects, DGDDI).

1. French customs agencies and organizational structure:

French Customs is the main agency in France responsible for supervising imported and exported goods and enforcing customs regulations. This agency has multiple customs branches and offices, responsible for managing customs affairs in various regions. In addition, France has some special customs agencies, such as the Customs Criminal Investigation Department, which are responsible for combating smuggling and other customs violations.

2. France’s import and export processes and procedures:

Declaration and Inspection:

Imports and exports in France require declaration for customs inspection and supervision. The declaration typically needs to include detailed descriptions of the goods, their value, quantity, origin, and other relevant information. This information is submitted through France’s electronic declaration system or relevant customs documents.

Security Inspection and Audit:

French customs may conduct security inspections and audits on imported and exported goods to ensure compliance and safety. This includes physical inspections or document reviews of specific types of goods to ensure they meet regulatory requirements.

Tariffs and Tax Collection:

France levies applicable tariffs and taxes on imported goods in accordance with the EU’s tariff schedule and domestic tax laws. This may include customs duties, value-added tax (VAT), and other specific taxes, which are imposed based on the nature and value of the goods.

3. France’s special tariffs and tax regulations:

Value Added Tax (VAT):

France imposes value added tax on imported goods, with the rate usually based on the classification and value of the goods. VAT is France’s main consumption tax and applies to domestically produced and imported goods.

Excise Duty:

France may impose excise duty on specific types of goods such as tobacco, alcoholic beverages, and gasoline. These taxes are usually aimed at regulating consumption behavior and protecting public health.

Customs clearance rules in the UK (post-Brexit)

1. Establishment of UK Customs and Borders:

With the United Kingdom’s official departure from the European Union in 2020, the UK government established the UK Border Force and HM Revenue & Customs (HMRC) to manage border and customs affairs. The UK Border Force is responsible for border security and immigration control, while HM Revenue & Customs is responsible for customs duty collection, trade compliance, and border checks.

2. The impact of Brexit on customs clearance rules:

Re-establish the border:

After Brexit, the United Kingdom re-established its borders with European Union member states. This means that import and export goods must comply with new customs clearance procedures, including customs declaration, inspection, and clearance.

New trade relations:

The UK and the EU reached a trade and cooperation agreement, establishing a new trade framework. This has led to changes in some trade processes and tariff policies, impacting businesses’ import and export activities.

Technical and personnel training:

To adapt to the new customs regulations, the UK government has intensified training for customs and trade professionals and invested in new customs technology and facilities to enhance the efficiency and security of border management.

Italian customs clearance rules

1. Italian Customs Agencies and Responsibilities:

The customs authority in Italy is the Guardia di Finanza, which is responsible for supervising and executing the customs procedures for imports and exports, including tariff collection, regulatory compliance oversight, and combating smuggling activities.

2. Requirements for import and export procedures:

Imported and exported goods must comply with Italy’s customs requirements, including proper customs declaration, payment of applicable duties and taxes, adherence to regulatory provisions, and, depending on the nature and value of the goods, obtaining specific permits or certificates.

3. Italy’s special trade zones and preferential policies:

Italy has established several special trade zones, such as free trade zones and bonded areas, which provide favorable conditions and incentives for businesses, thereby promoting the development of trade and investment activities. Additionally, the Italian government has implemented various trade promotion policies, such as tariff exemptions and preferential trade conditions, to encourage the growth of import and export businesses.

Spanish customs clearance rules

1. Organizational structure and functions of Spanish Customs:

Customs management in Spain is the responsibility of the Spanish Tax Agency (Agencia Tributaria), with the Customs and Excise Department (Departamento de Aduanas e Impuestos Especiales) being the main institution in charge of customs affairs. Its functions include, but are not limited to:

- ① Managing and executing the customs clearance procedures for import and export goods, including customs declaration, inspection, and clearance.

- ② Levying duties, value-added tax, and other taxes on imported and exported goods.

- ③ Combating smuggling and other customs violations.

- ④ Providing customs advisory and guidance services.

2. Customs clearance procedures and document requirements in Spain:

Import and export goods must comply with Spain’s customs procedures and document requirements. The main procedures include, but are not limited to:

- ① Submitting customs declarations for import and export goods, including detailed descriptions, value, quantity, and other relevant information.

- ② Depending on the nature and value of the goods, specific permits, certificates, or health and quarantine certificates may be required.

- ③ Payment of applicable duties, value-added tax, and other taxes.

3. Spain’s tariff policies and trade agreements:

EU Customs Union:

As a member of the European Union, Spain participates in the EU Customs Union, implementing a unified customs policy along with other member states. This means that there are no tariffs on trade within the European Union, and for imported goods from non-EU countries, the EU’s tariff schedule applies.

Bilateral Trade Agreements:

Spain has signed a series of bilateral trade agreements with other countries and regions to promote trade cooperation and economic exchange. These agreements may include tariff reductions, preferential trading terms, etc., helping to expand trade volume between Spain and its trading partners.

Special Trade Zones and Preferential Policies:

Spain has established several special trade zones (such as Free Trade Zones, Bonded Warehouses, etc.), providing convenient conditions and preferential policies for businesses, promoting the development of trade and investment activities. Additionally, the Spanish government has implemented some trade promotion policies, such as tariff exemptions, preferential trading conditions, etc., to encourage the growth of import and export businesses.

Overview of customs clearance rules in other European countries

1. Belgium:

Customs Organization and Functions:

Customs affairs in Belgium are managed by the Federal Public Service Finance. The Customs and Excise Administration is the primary agency responsible for customs clearance matters.

Customs Procedures and Documentation Requirements:

Import and export goods must comply with Belgium’s customs procedures and documentation requirements, including applicable customs declarations, tax payments, certificates, and licenses.

Tariff Policy and Trade Agreements:

Belgium, as a member of the European Union, participates in the EU’s Customs Union, implementing a unified tariff policy along with other member states. Additionally, Belgium has signed bilateral trade agreements with other countries, fostering trade cooperation with its trading partners.

2. Netherlands

Customs Organization and Functions:

Customs affairs in the Netherlands are managed by the Netherlands Tax and Customs Administration. Its Customs department is responsible for supervising and executing the clearance procedures for import and export goods.

Customs Procedures and Document Requirements:

Customs procedures and document requirements in the Netherlands are similar to those in other EU countries and include applicable customs declarations, tax payments, certificates, permits, etc.

Tariff Policy and Trade Agreements:

The Netherlands, as a member of the European Union, participates in the EU Customs Union. Additionally, the Netherlands has signed a series of bilateral and multilateral trade agreements with other countries, promoting trade between the Netherlands and its trading partners.

3. Sweden

Customs Organization and Functions:

Customs affairs in Sweden are managed by the Swedish Customs (Swedish Customs Administration). The Customs Administration is responsible for overseeing and executing the customs procedures for the import and export of goods, ensuring compliance and security of the goods.

Customs Procedures and Document Requirements:

Import and export goods must comply with Sweden’s customs procedures and document requirements, including the relevant customs declarations, payment of taxes and fees, certificates, and licenses.

Tariff Policy and Trade Agreements:

Sweden, as a member of the European Union, participates in the EU’s Customs Union. Additionally, Sweden has signed a series of bilateral and multilateral trade agreements with other countries, providing market access and facilitating trade for its trading partners.

Our company specializes in exporting cars from China, please contact us if you are interested.

Why is the share of joint venture cars brands in China declining?

On March 27th, at the 2023 financial report investor conference, Chairman of BYD, Wang Chuanfu, stated, “The accelerated launch of new energy products by Chinese car companies will erode the market share of joint venture brands. Over the next 3-5 years, the market share of joint venture brands will decrease from 40% to 10%, with 30% representing the growth potential for Chinese brands.”

This means that in a few years, the market share of domestic brands will reach 90%, with 9 out of every 10 cars purchased by consumers being domestically produced.

It sounds a bit exaggerated. Could it be that Mr. Wang is just boasting in front of investors?

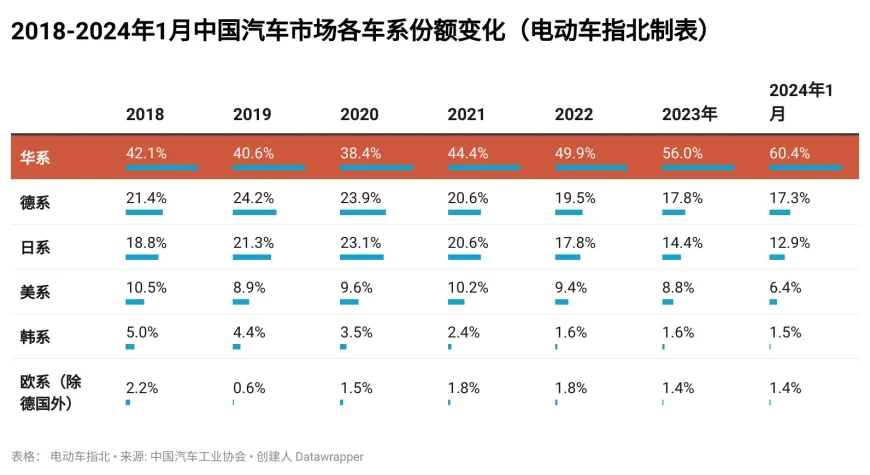

In 3 years, the market share of Chinese brands increased from 38.4% to 60.4%.

The market share of Chinese automotive brands has long struggled around 40%, which has been widely regarded as the “threshold” for Chinese automotive brands. In 2020, it hit a low point for Chinese brands, with a share of only 38.4%. However, it has rapidly increased year by year, reaching 56% in 2023 and even hitting 60.4% in January of this year.

Specifically, from 2020 to January 2024, among joint venture vehicles, the Japanese brands experienced the largest loss in market share, dropping from 23.1% to 12.9%, a decrease of 10.2 percentage points. Following them, German brands also experienced a decline from 23.9% to 17.3%, a decrease of 6.6 percentage points. American and Korean brands also lost 3.2 and 2.0 percentage points, respectively.

The main reason for the rapid loss of market share among joint venture vehicles is their weakness in the electric vehicle sector.

The penetration rate of electric vehicles has reached 45%, and Chinese brands have successfully overtaken the curve.

Based on the number of insurance policies issued, the penetration rate of electric vehicles has consistently exceeded 45% in the past 3 weeks, with the majority being Chinese brands. For example, according to data from the China Passenger Car Association, in February 2024, the penetration rate of electric vehicles among Chinese brands was 55.3%, among luxury cars it was 24%, while among mainstream joint venture brands it was only 4.9%. This means that for every 20 new cars sold by mainstream joint venture brands, 19 are fuel-powered vehicles, and only one is an electric vehicle.