Why is the share of joint venture cars brands in China declining?

On March 27th, at the 2023 financial report investor conference, Chairman of BYD, Wang Chuanfu, stated, “The accelerated launch of new energy products by Chinese car companies will erode the market share of joint venture brands. Over the next 3-5 years, the market share of joint venture brands will decrease from 40% to 10%, with 30% representing the growth potential for Chinese brands.”

This means that in a few years, the market share of domestic brands will reach 90%, with 9 out of every 10 cars purchased by consumers being domestically produced.

It sounds a bit exaggerated. Could it be that Mr. Wang is just boasting in front of investors?

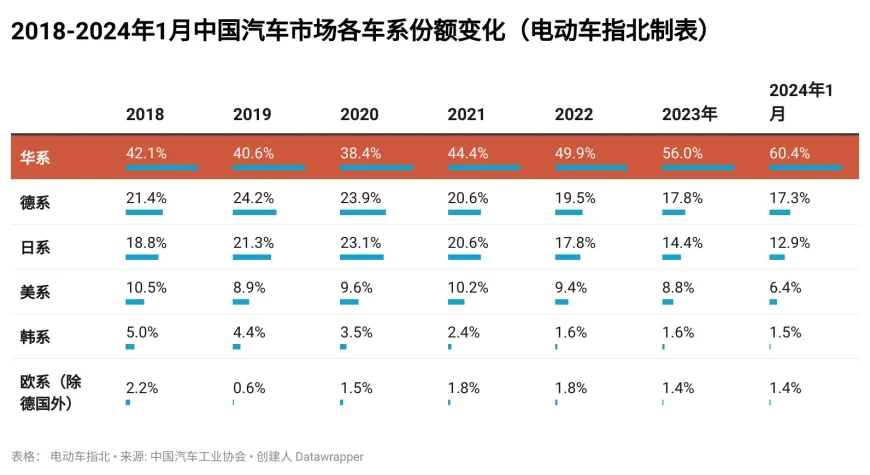

In 3 years, the market share of Chinese brands increased from 38.4% to 60.4%.

The market share of Chinese automotive brands has long struggled around 40%, which has been widely regarded as the “threshold” for Chinese automotive brands. In 2020, it hit a low point for Chinese brands, with a share of only 38.4%. However, it has rapidly increased year by year, reaching 56% in 2023 and even hitting 60.4% in January of this year.

Specifically, from 2020 to January 2024, among joint venture vehicles, the Japanese brands experienced the largest loss in market share, dropping from 23.1% to 12.9%, a decrease of 10.2 percentage points. Following them, German brands also experienced a decline from 23.9% to 17.3%, a decrease of 6.6 percentage points. American and Korean brands also lost 3.2 and 2.0 percentage points, respectively.

The main reason for the rapid loss of market share among joint venture vehicles is their weakness in the electric vehicle sector.

The penetration rate of electric vehicles has reached 45%, and Chinese brands have successfully overtaken the curve.

Based on the number of insurance policies issued, the penetration rate of electric vehicles has consistently exceeded 45% in the past 3 weeks, with the majority being Chinese brands. For example, according to data from the China Passenger Car Association, in February 2024, the penetration rate of electric vehicles among Chinese brands was 55.3%, among luxury cars it was 24%, while among mainstream joint venture brands it was only 4.9%. This means that for every 20 new cars sold by mainstream joint venture brands, 19 are fuel-powered vehicles, and only one is an electric vehicle.

This roughly translates to an inverse relationship between the penetration rate of electric vehicles and that of joint venture cars. For every 1% increase in the penetration rate of electric vehicles, the penetration rate of joint venture cars decreases by nearly 1%. Among them, Mercedes-Benz, BMW, and Audi’s electric vehicles perform slightly better, but at a considerable cost. For instance, the BMW i3 now starts at just over 210,000 yuan, while the Mercedes-Benz EQE starts at just over 270,000 yuan. These two electric vehicles are both cheaper by around 100,000 yuan compared to their fuel-powered counterparts in the same segment, which can be described as “selling cars at a loss.”

More critically, by 2024, joint venture brands have not produced any competitive electric vehicle products. Currently, joint venture electric vehicles are being labeled as “inferior” products. It can be foreseen that in the coming years, joint venture brands will still rely on fuel-powered vehicles.

The utilization rate of production capacity is collapsing, dealers are withdrawing, and the collapse of joint ventures is accelerating.

Currently, joint venture cars still hold about 40% of the market share, which is actually a very fragile threshold. Once the market share of joint venture cars further decreases, their foundation will be compromised, and the downward trend in the future will only intensify.

There are two key factors contributing to this situation: production capacity utilization and dealerships.

Firstly, the automotive industry heavily relies on economies of scale, as costs are directly linked to production volume. For example, if a factory used to produce 10,000 cars per month, totaling 120,000 cars per year, and suddenly the monthly sales drop to 5,000 cars, the factory’s production capacity would need to decrease to 60,000 cars per year. However, the factory’s annual depreciation expenses and other fixed costs remain constant. Additionally, there would be a reduced need for workers, and the decrease in order quantities could lead to increased prices from suppliers. These factors would significantly increase the cost per vehicle. Therefore, manufacturers often prefer to reduce the retail price of cars to maintain sales volume and utilization of production capacity.

Brutal reality

In the past three years alone, joint venture cars have lost a significant 22 percentage points of market share. Considering China’s annual passenger car volume of about 22 million units, this means that the production capacity of joint venture cars has been forced to decrease by 4.84 million units per year during this period. Many employees at joint venture car factories have reported having “significantly longer holidays” than before. Even Toyota and Honda have started laying off workers. Additionally, Hyundai has sold its factories to companies like NIO, and such occurrences are expected to become more common in the future.

As factory production capacity utilization further declines, the per-vehicle cost for joint venture cars will begin to rise. In the context of a price war, joint venture cars are essentially bleeding on the battlefield, and the outcome is already evident.

However, the bigger crisis for joint venture cars lies in their dealerships.

continued losses

In 2023, joint venture cars were forced to engage in a year-long price war, and many of the costs were borne by the dealerships. For instance, dealerships of Honda reported losing over 10,000 RMB for each Accord sold, even after factoring in rebates, resulting in many of them having to withdraw from the market.

A large number of joint venture car dealerships are facing significant losses, with many owners compelled by their long-term partnerships and the hope of a potential turnaround to say, “We’re willing to stick it out for another year.” However, since 2024, the situation for joint venture cars has not improved but rather worsened. At this point, dealership owners will only accelerate their departure, leading to an increasing rate of closures among joint venture car dealerships.

With dealerships pulling out, joint venture cars undoubtedly become even harder to sell. For many people in smaller towns and areas, the absence of physical stores means they are less likely to consider buying a car, as it creates a lack of trust and security.

Write at the end

Taking a look at China’s neighbors Japan and South Korea, where domestic brands hold a staggering 93% and 83% market share respectively, the decline of joint venture car companies and the rise of domestic brands appear to be a normal commercial phenomenon. In the past, the dominance of joint ventures in the main market was merely a historical accident. What is happening today is simply a correction, with everyone returning to their rightful place.

Therefore, it’s likely that Chairman Wang is not exaggerating this time. The BYD Qin PLUS, priced at 79,800 RMB, has already been accelerating this process. We are all witnesses to history.