Overview of China’s Car Exports in January 2024

According to data from the GlobalNEVS platform, China exported 319,600 passenger vehicles in January 2024, a year-on-year increase of 50.14%. Among them, the export of new energy passenger vehicles was 93,900, accounting for 29.38% of the total passenger vehicle exports.

The export growth rate of automobiles is fast

The export growth rate of passenger vehicles in China is rapid, with electric vehicles accounting for over one-third of the total.

According to data from the GlobalNEVS platform, China’s passenger car export growth has remained above 60% for the past three years. Since surpassing the milestone of one million units in 2021 with passenger car exports reaching 1.64 million units, exports further increased to 2.676 million units in 2022 and reached 4.426 million units in 2023, surpassing the 4-million mark with a remarkable growth rate of 65.4%.

The export performance of China’s new energy passenger cars has also been impressive. In both 2021 and 2022, the growth rate of China’s new energy passenger car exports exceeded that of overall passenger car exports. In 2023, China exported 1.682 million new energy passenger cars, accounting for 38.01% of the total passenger car exports.

The country with the highest number of exports from China in 2023

The country that received the most exports of passenger vehicles from China in 2023 was Russia, with a year-on-year growth of over five times.

According to data from the GlobalNEVS platform, in 2023, the top three destination countries for Chinese passenger car exports were Russia, Mexico, and Belgium. In 2023, China exported a total of 756,000 passenger cars to Russia, a year-on-year increase of 555.4%. China exported 346,000 passenger cars to Mexico in 2023, a year-on-year increase of 66.2%. China exported a total of 212,000 passenger cars to Belgium in 2023, a year-on-year increase of 4.5%.

In 2023, the top four brands of Chinese passenger car exports to Russia were Chery, Haval, Geely, and EXEED. These four brands also ranked as the 2nd to 5th best-selling car brands in Russia in 2023.

Chery, ranking first, exported nearly 163,000 passenger cars to Russia in 2023, with a year-on-year cumulative increase of 307.2%, making it the second-best-selling brand of passenger cars in Russia in 2023. Haval, ranking second, exported nearly 119,000 passenger cars to Russia in 2023, with a year-on-year cumulative increase of 253.2%. Geely, ranking third, exported over 84,000 passenger cars to Russia in 2023, with a year-on-year cumulative increase of 244.1%.

In 2023, BYD’s passenger vehicle exports saw a year-on-year growth of 324.4%

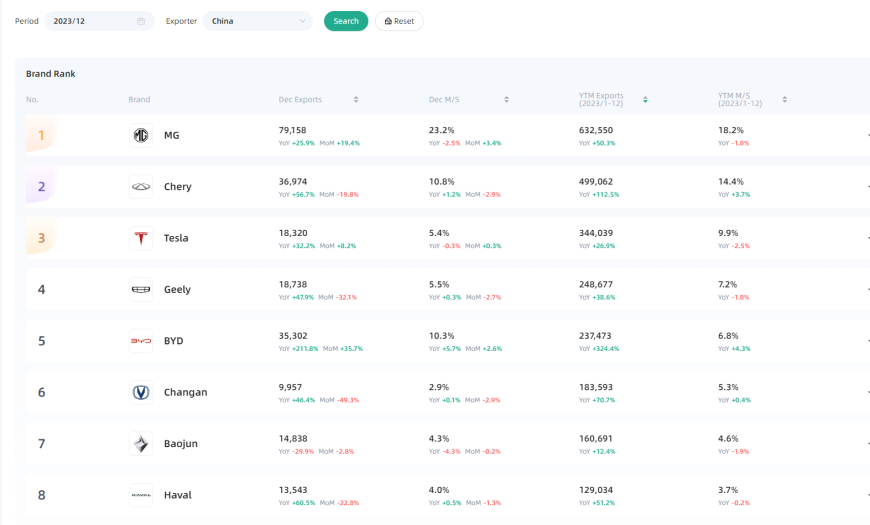

So, which brands are the main players in China’s passenger car exports? According to data from the GlobalNEVS platform, in 2023, the top three passenger car exporters from China were MG, Chery, and Tesla.

Among them, MG brand exported over 632,000 passenger vehicles in 2023, with a year-on-year growth of 50.3%. Chery brand exported over 499,000 passenger vehicles in 2023, with a year-on-year growth of 112.5%. After establishing a factory in Shanghai, China, and commencing production, Tesla also contributed to the increase in China’s passenger car exports. Tesla brand exported over 344,000 passenger vehicles in China in 2023, with a year-on-year growth of 26.9%.

Additionally, the export volume of BYD brand is worth noting. BYD exported over 237,000 passenger vehicles in 2023, with a year-on-year growth of 324.4%. Among them, electric passenger vehicles accounted for 84% of the exports, while plug-in hybrid passenger vehicles accounted for 16%. According to “China Newsweek” report, as of January 2024, BYD passenger vehicles have entered 59 countries and regions.

In 2024, China’s passenger car exports are expected to exceed 5 million units

Despite geopolitical changes and the impact of the COVID-19 pandemic on global automotive supply chains, China’s automobile exports have continued to rise. The increasing penetration of China’s new energy vehicles in the global market is attributed to its complete automotive supply chain and support from various countries’ policies.

Some industry experts predict that China’s passenger car exports will exceed 5 million units in 2024. Taking advantage of this favorable growth trend, Chinese automotive manufacturers and auto parts suppliers will accelerate their industrial layout worldwide. Automotive industry-related companies around the world can also seize cooperation opportunities in the trend of automobile exports, ushering in more development opportunities.